How much of your money should you really put into crypto? It’s not about chasing the next 10x coin or jumping in because your friend made a quick profit. It’s about protecting your financial future while still giving yourself a shot at the upside. The truth is, most people invest too much in crypto - and end up losing sleep over it.

Start With This Rule: Keep Crypto Under 10%

Financial advisors across the board agree: your crypto holdings should never exceed 10% of your total investment portfolio. For most people, 5% is the safer upper limit. Why? Because crypto is still wildly volatile. Even Bitcoin, the most stable major coin, can drop 30% in a month. If you’ve got 20% of your savings in crypto and the market crashes, you’re not just watching paper losses - you’re risking your ability to pay rent, save for a car, or handle an emergency.

Research from 21Shares, covering data from April 2022 to March 2025, shows that portfolios with just 1-3% in crypto actually performed better than those with none - without adding meaningful risk. That’s not a fluke. It’s proof that even a tiny slice of crypto can improve returns over time, as long as you don’t overdo it.

Your Income Determines Your Crypto Budget

There’s no one-size-fits-all number. Your crypto allocation should scale with your income and financial stability. Here’s what the data shows for 2025:

- If you earn $1,500 a month, stick to 1% - that’s $15. Put it all in Bitcoin using dollar-cost averaging. No altcoins. No leverage. Just buy a little every week.

- If you earn $3,000 a month, you can go up to 3% - $90. Split it between Bitcoin and Ethereum. Still no risky tokens.

- If you earn $5,000 a month, 5% ($250) is reasonable. Now you can add one or two solid DeFi tokens, but keep the rest in Bitcoin and Ethereum.

- If you earn over $8,000 a month and have a solid emergency fund, retirement savings, and no high-interest debt, you can consider 10% or more. But even then, don’t throw everything into crypto. Stay diversified.

This isn’t about being rich. It’s about being responsible. Someone making $3,000 a month doesn’t have the same safety net as someone making $12,000. If you’re living paycheck to paycheck, crypto shouldn’t even be on your radar yet.

Inside Your Crypto Portfolio: What to Own

Once you decide how much to invest, the next question is: what do you buy? Most people make the mistake of chasing the hottest new token. That’s how you lose money.

Follow the institutional model:

- 60-70% Core Assets: Bitcoin and Ethereum. These are the foundation. They’re the most liquid, the most regulated, and the most likely to survive the next decade. Don’t ignore them.

- 20-30% Altcoins: Layer-1 chains like Solana or Avalanche, Layer-2s like Arbitrum, and DeFi tokens like Aave or Uniswap. These are higher risk but offer higher potential returns. Only invest here after you’ve got your core locked in.

- 5-10% Stablecoins: USDC or USDT. These aren’t for speculation. They’re for holding cash when the market tanks. You can earn yield on them through DeFi platforms, and they let you buy the dip without selling your Bitcoin.

Example: If your total crypto budget is $1,000, put $650 in Bitcoin and Ethereum, $250 in altcoins, and $100 in stablecoins. Rebalance every six months. If Bitcoin spikes and now makes up 80% of your crypto portfolio, sell a bit and buy back altcoins or stablecoins to get back to your target.

Why You Should Avoid Crypto If You’re Not Ready

Not everyone should invest in crypto. Morningstar’s analysis makes this clear: as crypto becomes more mainstream, its correlation with stocks and bonds is rising. That means it’s losing its superpower - diversification. If crypto moves with the S&P 500, why take the extra risk?

Also, crypto is still a speculative asset. No one can accurately value it like they can value a company’s earnings or a rental property’s cash flow. That makes it dangerous for emotional investors.

Here are red flags you’re overinvesting:

- You check your portfolio every hour.

- You panic-sell when Bitcoin drops 5%.

- You’ve used your emergency fund to buy crypto.

- You’re following crypto influencers on TikTok and buying whatever they recommend.

- You’ve got 100% of your savings in crypto.

If any of these sound familiar, you’re not investing - you’re gambling. And gambling with your financial future is never worth it.

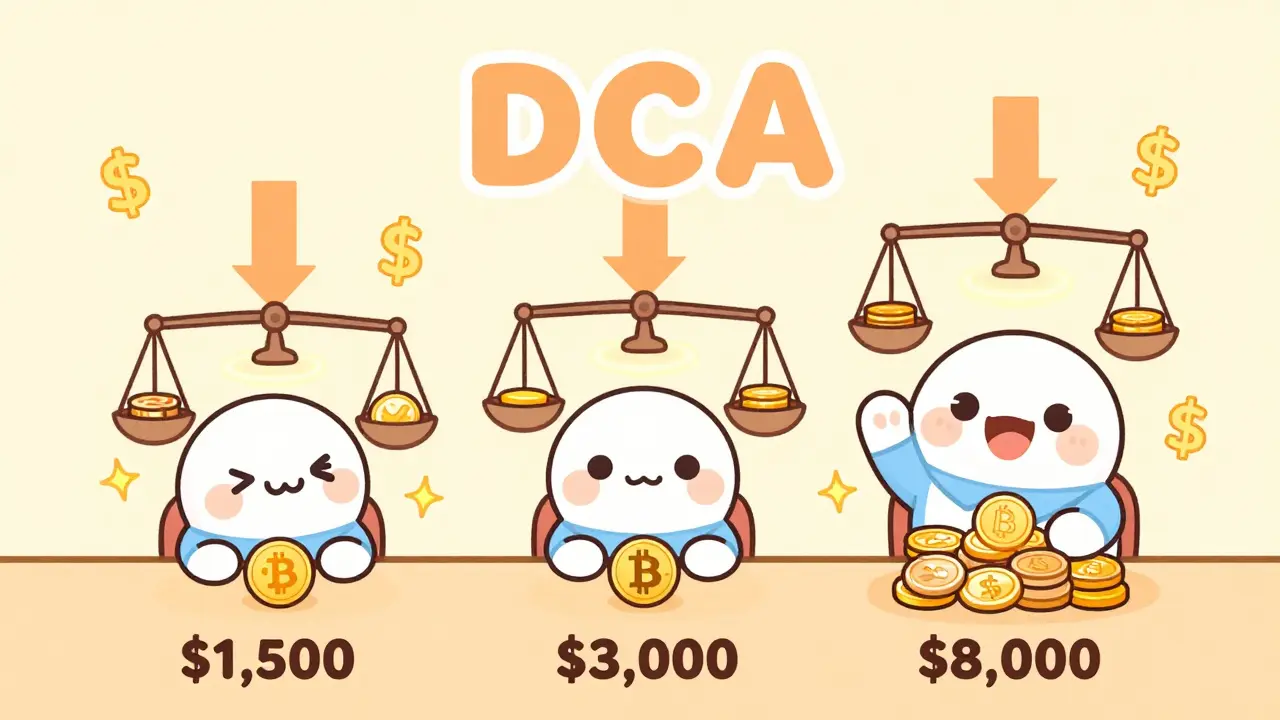

Use Dollar-Cost Averaging - Always

Never buy a big chunk of crypto all at once. Even if you think you’ve found the bottom. Even if everyone says it’s going to $100,000 next week.

Instead, use dollar-cost averaging (DCA). Buy a fixed amount every week or every two weeks. It removes emotion. It smooths out volatility. It forces discipline.

Look at the numbers: $1,000 invested in Bitcoin ten years ago would be worth around $350,000 as of May 2025. But that investor didn’t buy $1,000 in one day. They bought $50 every month for two years. Then kept adding. That’s how you win in crypto - not by timing the market, but by staying in it.

Let Your Sleep Be Your Guide

Here’s the simplest test: how well are you sleeping?

If you wake up in the middle of the night worrying about your portfolio, your crypto allocation is too high. If you feel anxious every time you open your app, you’re not investing - you’re stressing.

True investing doesn’t keep you up. It gives you peace. Crypto should be a small part of a bigger plan - not the whole plan.

The Future Is Gradual, Not Explosive

Bitcoin’s volatility is going down. Prices are going up. That’s a sign the market is maturing. The question isn’t whether to invest anymore - it’s when to start. But that doesn’t mean you should go all in.

Even as institutions pour money in, regulators are watching. New rules could change everything overnight. That’s why you need to stay small, stay diversified, and stay calm.

Think of crypto like a lottery ticket - but one you buy every month. You don’t bet your rent on it. You don’t quit your job for it. You just keep buying a little, and hope it pays off over time. That’s the smart way.

Most people lose money in crypto not because the market is rigged - but because they invest too much, too fast, without a plan. You don’t need to be a genius to win. You just need to be patient.

What If You’re Already Overallocated?

If you’ve already put 30% of your portfolio into crypto and it’s scaring you, don’t panic-sell. Don’t double down. Do this:

- Stop adding more money.

- Set a 12-month plan to slowly reduce your exposure.

- Every quarter, sell 5-10% of your crypto and move it into index funds, bonds, or cash.

- Use the proceeds to build an emergency fund if you don’t have one.

- Rebalance your portfolio back to 5% or less over the next year.

It’s not about recouping losses. It’s about protecting your future.

Richard Kemp

January 30, 2026 AT 16:32Crystal Underwood

January 31, 2026 AT 04:17Rico Romano

January 31, 2026 AT 06:34Jerry Ogah

February 1, 2026 AT 04:01Raymond Pute

February 1, 2026 AT 21:42Elle M

February 3, 2026 AT 06:03josh gander

February 3, 2026 AT 22:26