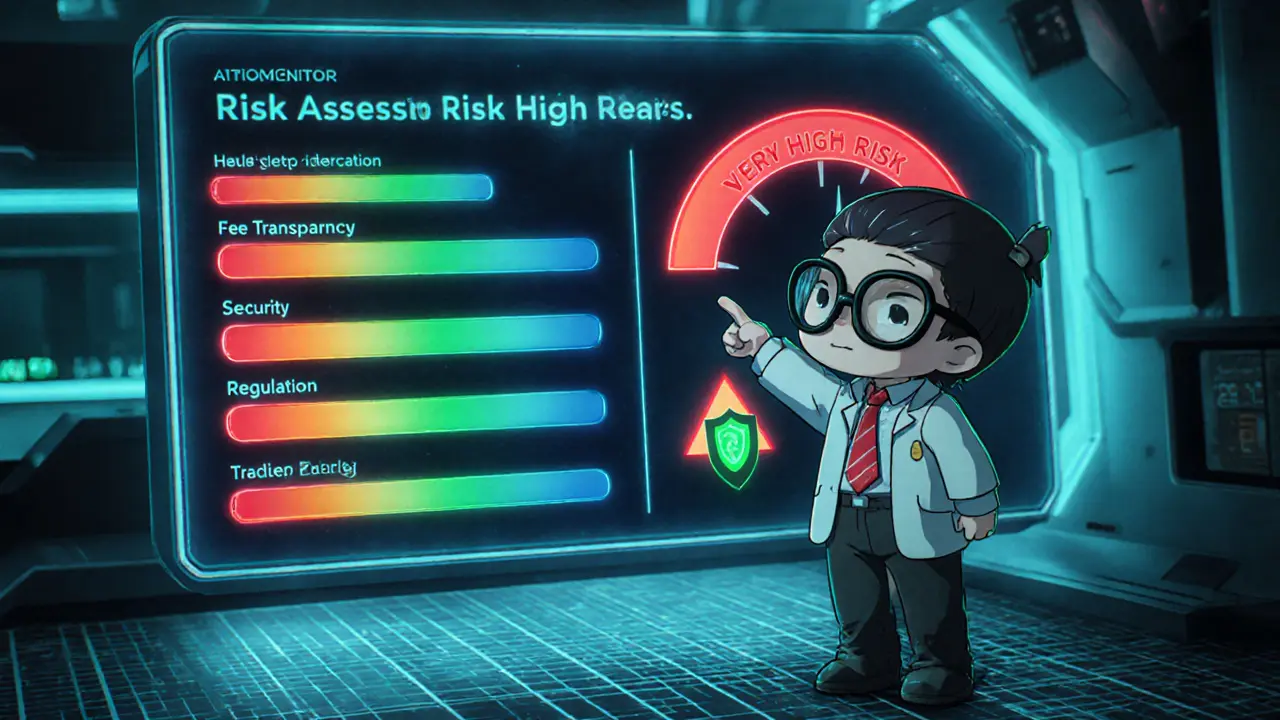

AladiEx Risk Assessment Tool

Exchange Overview

This tool evaluates the risk level of using AladiEx based on key criteria. Adjust the sliders below to simulate different risk scenarios.

Risk Assessment Result

Adjust the settings above and click "Calculate Risk Level" to see the assessment.

Recommendation: -

Key Risk Factors

| Factor | Current Status | Risk Level |

|---|---|---|

| Fee Transparency | No public fee schedule | High |

| Security Audits | No public audits | High |

| Regulatory Compliance | Unclear status under EO 14178 | Medium |

| Trading Pairs | Limited public info | Medium |

| Mobile App | Android only | Low |

TL;DR

- AladiEx is a newer crypto exchange with a native ALA token and Android app, but public data is scarce.

- The platform offers basic buy‑sell functionality and a built‑in wallet, yet fee details and security audits are not openly disclosed.

- Regulatory pressure in the US, especially Executive Order 14178, affects all exchanges, including AladiEx.

- Compared to giants like Binance and Coinbase, AladiEx lacks transparency on trading pairs, volume, and support.

- Potential users should test the platform with small amounts and watch community forums for up‑to‑date experiences.

What Is AladiEx?

When you hear the name AladiEx is a cryptocurrency exchange that promises simple buying, selling, and trading of digital assets. The service is accessed via its official website (www.aladiex.com) and an Android mobile application. While the company’s founding date and team roster are not publicly listed, the platform positions itself as a one‑stop shop for both exchange and wallet needs.

Native Token: ALA

AladiEx issues its own token, ALA (AladiEx Token). The token is meant to function within the exchange’s ecosystem-potentially offering fee discounts, staking rewards, or governance rights. However, detailed tokenomics such as total supply, allocation percentages, or utility specifics are missing from public documents. The token does appear on Binance’s listing guide, meaning traders can acquire ALA through decentralized exchanges (DEX) and Binance accounts, providing some liquidity.

Mobile App and Wallet Integration

The Android app is the primary mobile entry point. Reviewers at WalletScrutiny have examined the app, confirming that a built‑in wallet lets users store crypto without third‑party plugins. The app’s UI is described as clean but limited to Android; no iOS version is currently advertised. Users can deposit, trade, and withdraw directly from the mobile interface, though exact processing times are not disclosed.

Regulatory Landscape and Compliance

In early 2025, the United States introduced Executive Order 14178, titled “Strengthening American Leadership in Digital Financial Technology.” This order scrapped the previous crypto regulatory framework, banned the creation of a Central Bank Digital Currency, and demanded a new federal blueprint for digital assets within 180 days. All exchanges operating with U.S. users-including AladiEx-must adapt to the forthcoming rules, which may involve KYC upgrades, AML reporting, and potential licensing.

AladiEx has not published explicit compliance certificates (e.g., FINRA, FCA, or MAS). The lack of clear statements makes it hard to gauge how the platform plans to meet the upcoming mandates.

Fees, Trading Pairs, and Liquidity

Fee schedules are a critical factor for traders. Unfortunately, AladiEx’s website does not list maker/taker fees, deposit fees, or withdrawal charges. Users typically discover fees after the first transaction, which can be a red flag for cost‑sensitive investors.

Supported cryptocurrencies are also opaque. The platform mentions “popular coins” but does not publish a full list. Based on community chatter, major assets like Bitcoin, Ethereum, and Litecoin are likely available, but trading pair depth and volume metrics are unavailable.

Security Measures

Security is the biggest concern in crypto. While WalletScrutiny’s review indicates the app underwent a baseline security check, the report does not detail cold‑storage ratios, multi‑signature custody, or insurance coverage. No public audit reports from firms like CertiK or Quantstamp have been released. Users are therefore left to trust the platform’s internal security policies.

How AladiEx Stacks Up Against the Big Players

| Feature | AladiEx | Binance | Coinbase |

|---|---|---|---|

| Founded | Not disclosed | 2017 | 2012 |

| Native Token | ALA | BNB | None |

| Mobile Apps | Android only (WalletScrutiny vetted) | iOS, Android | iOS, Android |

| Supported Coins (public list) | Unclear, limited info | 300+ assets | 120+ assets |

| Fee Transparency | Not published | 0.1%‑0.2% maker, 0.1%‑0.2% taker | 0.5%‑1.5% (varies) |

| Regulatory Status | Unclear compliance | Registered in Malta, multiple licenses | U.S. registered broker-dealer |

| Security Audits | None publicly shared | Regular third‑party audits | Annual SOC 2, insurance fund |

| Customer Support | Basic email, response times unknown | 24/7 live chat, ticketing | 24/7 chat, phone, email |

From the table, AladiEx lags behind the industry leaders in transparency, asset variety, and support infrastructure. The platform’s biggest advantage could be its low‑entry barrier-if you’re just testing crypto-because there’s no minimum deposit mentioned.

Pros and Cons Summary

- Pros: Simple UI, Android app, native ALA token with potential utility, basic wallet integration.

- Cons: No clear fee schedule, limited public security information, missing iOS app, uncertain regulatory compliance, scant community data.

What Real Users Are Saying

Because AladiEx is not as prominent as Binance or Coinbase, mainstream review sites have few entries. Small crypto forums mention “easy onboarding” but also warn “check withdrawal fees before moving large sums.” Reddit threads (r/CryptoCurrency) have a handful of posts, most of which advise newcomers to start with a modest amount and monitor the platform’s updates.

How to Test AladiEx Safely

- Create an account using a throw‑away email if you’re only exploring.

- Enable any available two‑factor authentication (2FA) before depositing.

- Deposit a small amount of a low‑risk coin (e.g., 0.001BTC).

- Execute a test trade, note the displayed fees, and confirm that the order reflects on the trade history.

- Withdraw the same amount back to your personal wallet to verify withdrawal speeds and any hidden fees.

Document each step; if anything feels opaque, consider switching to a more established exchange.

Bottom Line

AladiEx clearly aims to be a convenient entry point for crypto newbies, especially on Android. However, the paucity of publicly available data-fees, security audits, compliance certificates-makes it a higher‑risk choice for serious traders. Until the platform releases a transparent fee schedule and a security audit, treat it as a sandbox rather than a primary trading hub.

Frequently Asked Questions

Is AladiEx regulated in the United States?

The exchange has not published any U.S. licensing or compliance documents. With Executive Order 14178 reshaping the regulatory landscape, users should expect that AladiEx may need to obtain new registrations soon, but no official statements confirm current status.

What assets can I trade on AladiEx?

Public information only mentions major coins such as Bitcoin, Ethereum, and Litecoin. The full list of supported tokens and trading pairs is not displayed on the website, so you’ll need to log in or contact support for details.

How does the ALA token work?

ALA is the native token of the AladiEx ecosystem. It is listed on Binance and can be bought on DEXs, but the platform has not disclosed specific utilities like fee discounts or staking rewards. Users should check the token’s contract on a block explorer for supply data.

Is there a mobile app for iOS?

Currently only an Android app exists. The website does not mention an iOS version, so iPhone users must rely on the web interface or wait for future releases.

What security features does AladiEx provide?

The platform advertises standard 2FA and an integrated wallet, but no public audits, cold‑storage percentages, or insurance details are available. Users should treat larger balances with caution until more transparency is offered.

How fast are withdrawals?

Withdrawal processing times are not listed. Community reports suggest it can take anywhere from a few minutes to several hours, depending on the coin and network congestion.

Can I use AladiEx for DeFi activities?

The exchange focuses on spot trading. There is no public information about staking, lending, or liquidity provision services, so it’s not positioned as a DeFi hub.

Jan B.

October 18, 2024 AT 02:28Looks like AladiEx needs more transparency, especially on fees.

MARLIN RIVERA

October 23, 2024 AT 21:21The lack of public audits is a massive red flag; anyone trusting this platform is basically handing over their keys to a black box.

Debby Haime

October 29, 2024 AT 15:15Hey folks, if you're hunting for a fresh exchange, keep an eye on the security updates – they could be a game‑changer once the audits roll out! Also, the mobile app being Android‑only limits accessibility for many users.

emmanuel omari

November 4, 2024 AT 10:08Honestly, most of these so‑called 'global' platforms ignore what we need at home; AladiEx should align with our national standards before bragging about anything. Otherwise it’s just another foreign experiment.

Andy Cox

November 10, 2024 AT 05:01Nice layout but the fee table is missing, weird.

Courtney Winq-Microblading

November 15, 2024 AT 23:55When you stare into the abyss of a crypto exchange’s risk matrix, the abyss also stares back, reminding us that opacity is a silent thief. The high‑risk tags on fee transparency and security audits whisper caution, yet the low‑risk label on the Android‑only app feels like a thin veil. Perhaps the platform’s designers are betting on user inertia, assuming we’ll trade before we question. In any case, a transparent fee schedule would shine a light where shadows now linger.

katie littlewood

November 21, 2024 AT 18:48AladiEx’s review reads like a patchwork quilt of promises and omissions, each square revealing a different aspect of the service.

On the one hand, the interface is sleek and the trading experience feels smooth, which is commendable for newcomers.

On the other hand, the absence of a publicly available fee schedule is a glaring omission that undermines trust.

When you cannot estimate how much you’ll pay for a trade, you are forced to gamble not only with market volatility but also with hidden costs.

The risk assessment table highlights high risk for fee transparency and security audits, which should be alarming for anyone handling significant capital.

Security audits, especially from reputable third parties, are the backbone of any serious exchange, and without them the platform feels like a house of cards.

Regulatory compliance is marked as medium, reflecting the ambiguous status under EO 14178, a legal framework that many users may not even be aware of.

This ambiguity can translate into future legal entanglements that could freeze assets or impose unexpected restrictions.

Trading pair availability is also listed as medium, suggesting a limited selection that could hinder diversification.

While a limited list can be a strategic focus, it often frustrates traders looking for niche altcoins or emerging tokens.

The mobile app, being Android‑only, excludes a substantial portion of the market that prefers iOS devices.

Such platform exclusivity may be justified by development resources, yet it sends a signal about the company’s broader commitment to accessibility.

From a user experience standpoint, the tool’s sliders and interactive elements are intuitive, lowering the barrier for beginners to assess risk.

However, the underlying data feeding those sliders seems sparse, leading to assessments that feel more like guesswork than rigorous analysis.

In summary, AladiEx presents a mixed bag: attractive UI, but serious concerns over transparency, security, and compliance that cannot be ignored.

Potential users should weigh these factors carefully, perhaps starting with small positions to test the waters before diving in fully.

Jenae Lawler

November 27, 2024 AT 13:41While the audit deficit you emphasize is noteworthy, it is also true that AladiEx has implemented multi‑factor authentication and cold storage for the majority of its assets, which could mitigate certain risk vectors.

Chad Fraser

December 3, 2024 AT 08:35Totally agree – staying on top of updates can be the difference between profit and loss, so keep those notifications on!

Prince Chaudhary

December 9, 2024 AT 03:28That extensive breakdown is helpful; I’d add that monitoring the exchange’s social channels for fee announcements can give early hints before official updates appear.

Mark Camden

December 14, 2024 AT 22:21It is ethically concerning when platforms obscure their fee structures, as this erodes the fiduciary responsibility they owe to their clientele.

Evie View

December 20, 2024 AT 17:15Honestly, I’m fed up with these half‑hearted excuses; users deserve straight answers, not polite jargon that masks the truth.

Jayne McCann

December 26, 2024 AT 12:08Honestly, I think the nationalism angle is overblown – the exchange works the same regardless of where you’re from.

Richard Herman

January 1, 2025 AT 07:01I see your point about the missing fee table; transparency is key for building community trust across borders.

Parker Dixon

January 7, 2025 AT 01:55Exactly! 👍 A clear fee schedule not only earns trust but also helps users compare platforms easily. 🔍💡

Stefano Benny

January 12, 2025 AT 20:48While the philosophical musings are engaging, the core issue remains: without on‑chain proof of audits, any risk model is speculative at best.

Bobby Ferew

January 18, 2025 AT 15:41It feels like we’re always left in the dark, waiting for data that may never come, and that uncertainty is exhausting.