Indonesia lets you trade cryptocurrency legally - but you can’t use it to buy coffee, pay for a taxi, or settle an online order. That’s the strange reality of crypto in Indonesia. While millions of people trade Bitcoin, Ethereum, and other digital assets, the central bank has made it crystal clear: crypto is not money here. It’s not illegal to own it. It’s not illegal to buy or sell it. But if you try to use it to pay someone? That’s against the law.

Why Does Indonesia Ban Crypto Payments?

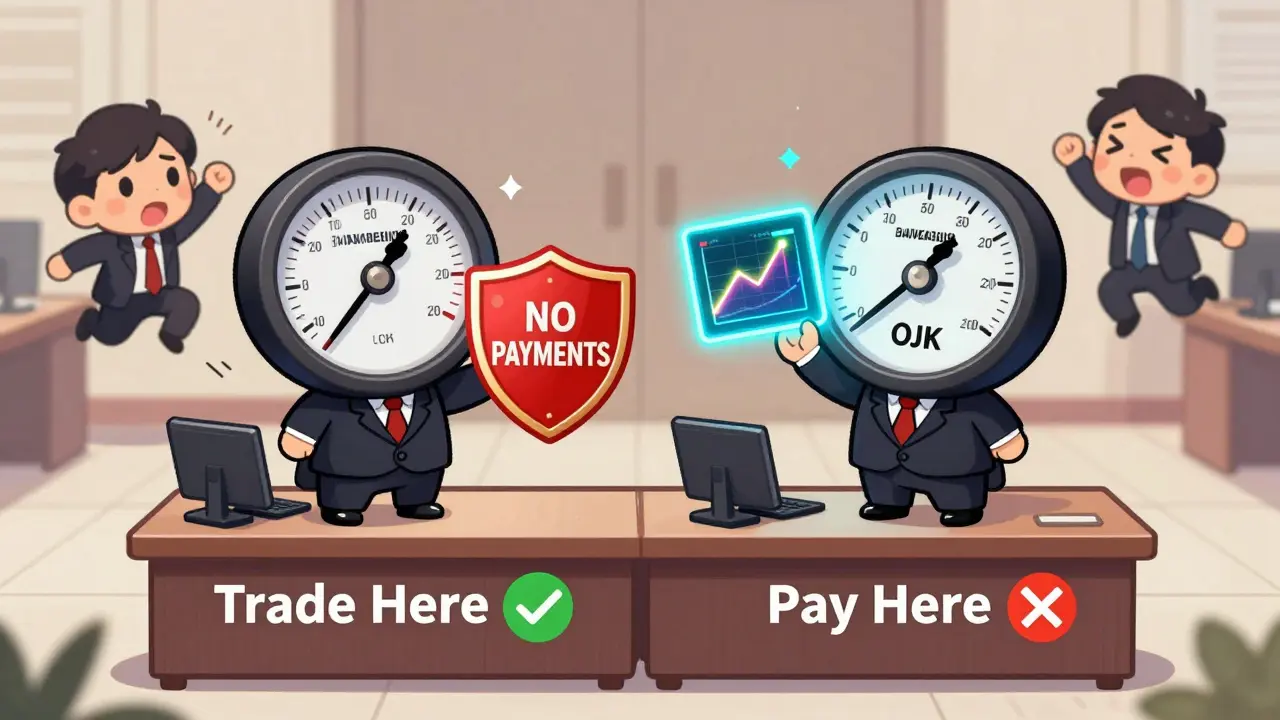

The answer starts with the rupiah. Indonesia’s Currency Law says only the rupiah is legal tender. That’s not just a rule - it’s a constitutional principle. Bank Indonesia, the country’s central bank, has held this line since 2017. In 2016 and 2017, they issued regulations (PBI 18/40 and PBI 19/12) that banned every kind of payment operator - from e-wallets to payment gateways - from processing transactions using virtual currencies. That includes Bitcoin, USDT, BNB, or any other crypto. The reasoning? Stability. Bank Indonesia worries that if people start using crypto for everyday payments, it could undermine the rupiah’s control over inflation, interest rates, and monetary policy. They also fear fraud, money laundering, and sudden price swings leaving consumers with worthless payments. In November 2025, Bank Indonesia’s Executive Director Agusman restated this clearly: "Virtual currency including bitcoin is not recognized as a valid payment instrument. It is prohibited to be used as a means of payment in Indonesia."Trading Is Fine - But Only Under OJK

Here’s where it gets interesting. While Bank Indonesia blocks payments, a different agency - the Financial Services Authority (OJK) - now runs the show for crypto trading. On January 10, 2025, oversight shifted from Bappebti (the commodities regulator) to OJK under Regulation No. 27 of 2024. Crypto assets were reclassified as "digital financial assets," not commodities. That’s a big deal. It means they’re now treated more like stocks or bonds than gold or soybeans. Under OJK’s rules, crypto exchanges must meet strict standards: a minimum capital of IDR 50 billion ($3.2 million), full AML/CTF compliance with FATF standards, 99.5% platform uptime, and real-time monitoring systems. All platforms must connect to OJK’s Digital Financial Innovation Monitoring System (SIM IAKD). These are not suggestions - they’re legal requirements. And there’s a surprise perk: OJK waived all regulatory fees for crypto businesses in 2025. Before, companies paid between IDR 50 million and IDR 500 million ($3,200-$32,000) per year. Now? Zero. That’s a major incentive to stay compliant and grow.The Payment Ban Creates a Weird Split

This creates a strange situation: Indonesia has one of the most advanced crypto trading frameworks in Southeast Asia, but still refuses to let that same technology be used for payments. Compare that to Thailand, which allows crypto payments for licensed merchants, or Singapore, where licensed providers can process crypto payments. Malaysia is even testing pilot programs to relax its ban. Indonesia’s approach is closer to Vietnam’s - ban payments, regulate trading - but with far more structure. The problem? Businesses feel stuck. According to Alvarez & Marsal’s July 2025 analysis, Indonesian companies face 37% higher costs and 3.2 extra days to complete international settlements because they can’t use crypto for cross-border payments. They’re forced to use slow, expensive traditional banking channels, even though they’re already using crypto for investment. William Sutanto, CTO of Indodax - Indonesia’s biggest exchange - called it "operational schizophrenia." One regulator says "trade freely," the other says "don’t pay with it." That confusion hurts innovation.

People Are Still Using Crypto to Pay - Illegally

Despite the ban, people are finding ways around it. A survey by Indodax in August 2025 found that 63% of users had made crypto-based payments anyway - mostly through peer-to-peer deals. Reddit and Kaskus forums are full of workarounds: merchants convert crypto to gift cards, prepaid credits, or even cash transfers to avoid triggering payment system flags. One merchant on Reddit, u/JakartaToko, lost a $12,000 international order because their customer’s company required payment in USDT. "BI’s payment ban cost me three months of revenue," they wrote. Another Kaskus thread, viewed over 47,000 times, showed that 82% of sellers use gift cards to bypass the ban. Professor Budi Suharjo from Universitas Gadjah Mada found that 68% of surveyed merchants accept crypto informally - even though they know it’s illegal. That creates a huge risk: no consumer protection, no dispute resolution, no legal recourse if a payment fails.Taxes Changed - But Not the Ban

On August 1, 2025, the Ministry of Finance made a major move. They scrapped the 1% VAT on crypto transactions and replaced it with a flat 0.21% final income tax. That’s a huge drop - and it shows the government wants to encourage crypto activity, just not as a payment tool. The Directorate General of Taxes (DJP) even created a special unit with 147 auditors to track crypto transactions. They’re linked directly to OJK’s SIM IAKD system, so every trade is visible. This isn’t about stopping trading - it’s about taxing it properly.Who’s Winning and Who’s Losing?

The crypto market in Indonesia is growing fast. In 2024, trading volume hit IDR 127.5 trillion ($8.1 billion). There are 14.3 million active users - over 5% of the population. Indodax controls 58% of the market, Tokocrypto 27%, and Pintu 15%. Binance, despite being global, holds just 0.3% because Indonesia’s licensing rules are so strict. Big companies are getting involved too. 87% of Indonesia’s top 100 publicly traded firms now report holding crypto assets - up from 52% in late 2024. That’s institutional adoption. But none of them can use crypto to pay suppliers or employees. They can only hold it as an asset. Meanwhile, talent is leaving. The Indonesian Blockchain Association reported that 27 crypto professionals moved to Singapore or Dubai in the first half of 2025. "If our fiscal approach remains rigid," said Robby, head of ABI, "we’re going to see brain drain and capital outflow."

What’s Next?

There’s talk of change. Indonesia’s House of Representatives is reviewing Draft Law No. 12/2025 on Digital Rupiah Integration. It could eventually allow crypto payments - but only through a central bank digital currency (CBDC) bridge. That means you’d still pay in rupiah, but the transaction might use blockchain tech behind the scenes. Bank Indonesia’s Governor Perry Warjiyo made it clear in October 2025: "Any relaxation of the payment prohibition would require comprehensive assessment of monetary policy transmission mechanisms." Translation? Don’t expect changes soon.What This Means for You

If you’re in Indonesia:- You can legally buy, sell, and hold crypto - as long as you use an OJK-licensed exchange.

- You cannot use crypto to pay for goods or services - even if the seller agrees.

- If you try to pay with crypto, you risk violating banking regulations - and the seller could be fined up to IDR 5 billion ($320,000).

- Don’t use P2P apps to pay for things. It’s not safe, and it’s not legal.

- You’ll pay 0.21% tax on every trade - no VAT anymore.

- Don’t integrate crypto payments. It’s not worth the risk.

- If you want to accept crypto, convert it immediately to rupiah through a licensed exchange - and document everything.

- Use OJK-compliant platforms only. Non-compliant exchanges could be shut down.

- Track your crypto holdings - the tax authorities are watching.

Frequently Asked Questions

Can I use Bitcoin to pay for something online in Indonesia?

No. Even if a website accepts Bitcoin, it’s illegal under Bank Indonesia regulations. Payment processors - including e-wallets, gateways, and merchant systems - are banned from handling crypto transactions. If you try to pay with Bitcoin, the transaction will fail or be flagged as a violation.

Is it legal to trade crypto in Indonesia?

Yes. Since January 2025, the Financial Services Authority (OJK) regulates crypto trading. You can buy and sell digital assets through licensed exchanges like Indodax, Tokocrypto, and Pintu. These platforms must meet strict capital, security, and reporting rules. Trading is fully legal - just not for payments.

What happens if I get caught using crypto to pay someone?

The person or business accepting the crypto payment could face penalties up to IDR 5 billion ($320,000). While individual users aren’t usually targeted, payment processors and merchants are. If a merchant uses a crypto payment gateway, their license could be revoked. The government is focused on stopping institutional use, not personal P2P transfers - but both are still illegal.

Do I have to pay tax on crypto profits in Indonesia?

Yes. Since August 1, 2025, you pay a flat 0.21% final income tax on every crypto transaction - whether you’re buying, selling, or swapping. The 1% VAT was removed, making it cheaper. The tax is automatically calculated and withheld by licensed exchanges. You don’t need to file separately unless you trade on foreign platforms.

Can I use crypto for international payments from Indonesia?

No. The ban applies to all payment types, including cross-border. Even if your foreign client wants to pay you in USDT, you cannot legally receive it as payment. You must use traditional bank transfers, SWIFT, or other approved channels. This is why many Indonesian businesses pay more and wait longer for international settlements.

Is there a chance the payment ban will be lifted?

Not anytime soon. Bank Indonesia has repeatedly said crypto cannot replace the rupiah. A draft law on Digital Rupiah (CBDC) is being reviewed, but that’s about creating a government-backed digital currency - not allowing Bitcoin or Ethereum as payment. Any future change would require a complete overhaul of monetary policy, which isn’t on the agenda.

Katherine Melgarejo

January 17, 2026 AT 06:57Patricia Chakeres

January 18, 2026 AT 09:22Anna Gringhuis

January 18, 2026 AT 10:03CHISOM UCHE

January 18, 2026 AT 10:09Pramod Sharma

January 18, 2026 AT 17:59Liza Tait-Bailey

January 18, 2026 AT 22:06nathan yeung

January 20, 2026 AT 01:06Bharat Kunduri

January 20, 2026 AT 03:53Chris O'Carroll

January 20, 2026 AT 20:46Christina Shrader

January 22, 2026 AT 01:43Tony Loneman

January 23, 2026 AT 05:54Jason Zhang

January 24, 2026 AT 07:40Lauren Bontje

January 24, 2026 AT 13:17Stephanie BASILIEN

January 26, 2026 AT 08:11Deb Svanefelt

January 27, 2026 AT 02:09Dustin Secrest

January 28, 2026 AT 11:53Stephen Gaskell

January 29, 2026 AT 11:13Shaun Beckford

January 31, 2026 AT 02:35Alexandra Heller

February 1, 2026 AT 17:01myrna stovel

February 2, 2026 AT 03:43Hannah Campbell

February 2, 2026 AT 13:14Josh V

February 4, 2026 AT 06:43