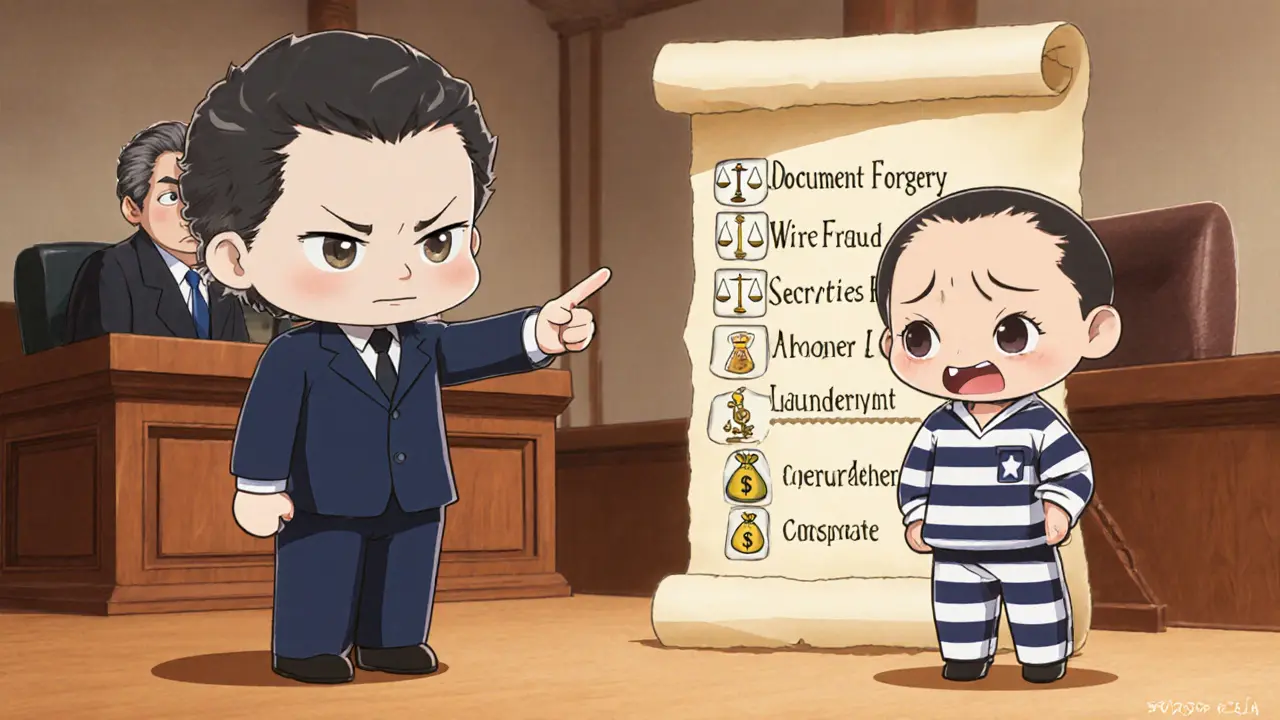

Federal Penalties Calculator for Crypto Exchange Forgery

Input Parameters

Estimated Penalties

Key Charges Overview

| Charge | Max Prison | Max Fine |

|---|---|---|

| Document Forgery | 20 years | $250K |

| Wire Fraud | 20 years | $250K |

| Securities Fraud | 20 years | $5M |

| Money Laundering | 20 years | $500K |

| Conspiracy | 5-20 years | $250K |

When a fraudster creates a fake ID to sneak into a cryptocurrency exchange, the fallout isn’t limited to a lost account - it triggers a cascade of federal crimes. Document forgery for crypto exchange access is a white‑collar offense that overlaps securities fraud, money‑laundering statutes, and strict KYC/AML rules enforced by multiple U.S. agencies. Understanding how the law treats each piece of the puzzle helps users, exchangers, and legal teams gauge the real risk.

TL;DR - What You Need to Know

- Forging IDs to bypass KYC is a federal crime that can carry up to 20 years in prison per count.

- Typical charges include wire fraud, securities fraud, and money‑laundering violations.

- Exchanges that ignore verification standards can face civil penalties and asset forfeiture.

- Advanced deep‑fake detection tools are now mandatory for many regulated platforms.

- Both individuals and the platforms can be sued for damages if fraud leads to financial loss.

How Forgery Fits Into the Federal Legal Framework

At its core, the act of fabricating a government‑issued ID to gain exchange access violates Title 18 of the United States Code, which criminalizes the creation, possession, or use of false documents. When the forged ID is used to open a crypto account, the offense expands into three intersecting statutes:

- Wire fraud (18 U.S.C. § 1343) - any scheme to defraud using electronic communications.

- Securities fraud (15 U.S.C. § 78j) - applies when the exchange offers tokens that qualify as securities or when the fraud induces investors to buy unregistered assets.

- Money‑laundering (18 U.S.C. § 1956) - covers the movement of illicit proceeds through the exchange.

Each count can be punished up to 20 years, and the sentencing guidelines consider the loss amount, the number of victims, and whether sophisticated AI tools were used to create the forgeries.

Key Regulators and Their Roles

Multiple agencies coordinate enforcement:

- Securities and Exchange Commission (SEC) - targets securities‑law violations and can impose civil injunctions.

- Financial Crimes Enforcement Network (FinCEN) - enforces AML/KYC rules, issues fines, and can refer cases to the DOJ.

- Department of Justice (DOJ) - brings criminal charges for forgery, wire fraud, and money‑laundering.

- Office of Foreign Assets Control (OFAC) - oversees sanctions compliance; violations can trigger settlements like the 2022 Kraken case.

Because cryptocurrency transactions cross state and national borders, federal jurisdiction is almost always invoked, meaning state‑level prosecutions are rare.

Typical Federal Charges and Maximum Penalties

| Charge | Statutory Basis | Max Prison | Typical Fine |

|---|---|---|---|

| Document forgery (18 USC §471) | False documents | 20 years | $250,000 (or twice the proceeds) |

| Wire fraud (18 USC §1343) | Electronic deception | 20 years | $250,000 per count |

| Securities fraud (15 USC §78j) | Misrepresentation in securities | 20 years | $5 million civil penalty + disgorgement |

| Money‑laundering (18 USC §1956) | Concealing illegal proceeds | 20 years | $500,000 per offense |

| Conspiracy (18 USC §371) | Agreement to commit a crime | 5 years (up to 20 if underlying crime severe) | $250,000 |

Why Exchanges Are Not Immune

Exchanges that fail to enforce robust KYC/AML controls can be deemed "knowing facilitators" of fraud. Liability can arise through:

- Willful blindness - ignoring red‑flag patterns that detection software flags.

- Negligent onboarding - using only single‑point ID verification without biometric or deep‑fake checks.

- Inadequate transaction monitoring - missing large, rapid trades that match typical laundering behavior.

Regulators have shown willingness to impose civil settlements that exceed $10million, as seen in the Kraken‑OFAC case. Moreover, victims can file private lawsuits alleging breach of fiduciary duty and negligence, potentially adding punitive damages.

Modern Detection Techniques: From Simple Checks to AI‑Driven Defense

Fraudsters now buy AI‑generated ID bundles on dark‑web marketplaces for as little as $15. These packs often include:

- High‑resolution government‑issued ID cards.

- Utility bills and tax statements for address verification.

- Synthetic video responses that mimic live‑face verification.

In response, leading KYC providers layer multiple checkpoints:

- Document element analysis - checking micro‑textures, hologram reflections, and UV patterns.

- Deep‑fake detection - algorithms scan video frames for unnatural blinking or lighting inconsistencies.

- External database cross‑reference - pulling data from government registries, credit bureaus, and sanction lists.

- Risk scoring - aggregating behavior signals (IP changes, device fingerprint, velocity of trades).

Each layer feeds into a machine‑learning model that continuously learns from newly flagged attempts, turning the arms race into a data‑driven advantage for the exchange.

Proving Intent: The Prosecutor’s Burden

To secure a conviction, the government must demonstrate two core elements:

- Knowledge - the defendant knowingly used a fabricated ID, rather than an accidental mistake.

- Intent to defraud - the forged document was created to bypass regulatory safeguards and gain illicit crypto assets.

Technical evidence (metadata from deep‑fake files, timestamps, and vendor logs) often forms the backbone of the case. Defense teams frequently attack the chain of custody for the digital evidence and argue that AI‑generated artifacts do not automatically imply criminal intent.

Case Study: A 2024 Federal Prosecution

In mid‑2024, a group of four individuals bought a dark‑web AI ID kit priced at $250. They used the package to open accounts on three U.S.-registered exchanges, moved roughly $12million in Bitcoin, and withdrew the funds across a network of mixers. The DOJ charged each defendant with:

- Document forgery (18 USC §471)

- Wire fraud (18 USC §1343)

- Money‑laundering conspiracy (18 USC §1956)

After a ten‑month trial, the jury returned guilty verdicts on all counts. Sentences ranged from 9 to 15 years, and the court ordered forfeiture of $11.8million in crypto assets plus $500,000 in fines per defendant.

Best‑Practice Checklist for Exchanges

- Implement multi‑factor authentication (MFA) for every new account.

- Adopt AI‑driven deep‑fake detection for video‑KYC.

- Maintain an up‑to‑date sanctions screening list (OFAC, EU, UK).

- Conduct periodic audits of KYC workflow compliance (at least quarterly).

- Establish a rapid‑response team to investigate flagged identity anomalies.

- Document all remediation steps to demonstrate good‑faith compliance during regulator inspections.

What Victims Can Do

If you discover that a forged account was used to steal your crypto, you have two legal avenues:

- Report the incident to the FBI and FinCEN - they can launch a criminal investigation.

- File a civil suit against the exchange for negligence, citing the platform’s failure to meet KYC standards.

Both routes benefit from preserving evidence: screenshots, transaction hashes, and any communications with the exchange.

Frequently Asked Questions

What federal crime covers fake IDs used on crypto exchanges?

Document forgery under 18U.S.C. §471 applies, and when the forged ID is used to open an account it triggers wire fraud, securities fraud, and money‑laundering statutes.

Can an exchange be criminally liable for a forged‑ID breach?

Yes. If regulators find the exchange knowingly ignored red‑flags or lacked adequate verification, the platform can face criminal contempt, hefty fines, and asset forfeiture.

How much can a person be sentenced for this type of fraud?

Each count (forgery, wire fraud, securities fraud, money‑laundering) carries a maximum of 20years in prison. Sentences often add up when multiple counts are stacked.

What detection tools should an exchange deploy today?

Modern KYC suites that combine document element analysis, AI deep‑fake detection, external data verification, and risk‑scoring engines are considered best‑practice.

If I’m a victim, how quickly should I act?

Immediately. Preserve all digital evidence, notify the exchange, and file reports with the FBI and FinCEN to increase the chance of recovery and prosecution.

Sidharth Praveen

May 4, 2025 AT 18:56Yo, forging docs to get into a crypto exchange is a risky hustle. The feds treat it like any other fraud, and you can end up with years behind bars and hefty fines.

Sophie Sturdevant

May 9, 2025 AT 15:36Indeed, the statutory penalties for document forgery can stack with wire fraud, securities fraud, and money laundering, creating a cumulative exposure that can exceed $5 million in fines and a potential 20‑year sentence per count. In crypto terms, that's a catastrophic drawdown on your portfolio.

Jan B.

May 14, 2025 AT 12:16Absolutely. The law looks at each charge separately and adds the maximums together.

MARLIN RIVERA

May 19, 2025 AT 08:56People think they can outsmart regulators with a fake ID, but the justice system doesn’t care about your cleverness. It’s a straight‑up crime that gets you locked up.

Debby Haime

May 24, 2025 AT 05:36Hey everyone, just a heads‑up that if you’re considering any shortcuts, the risk far outweighs any short‑term gain. Think about the long‑term impact on your reputation and freedom.

emmanuel omari

May 29, 2025 AT 02:16In my country we see these scams targeting innocent investors, and the authorities are tightening the net. Forgery isn’t a victimless act; it hurts the entire financial ecosystem.

Andy Cox

June 2, 2025 AT 22:56Honestly, the calculator tool they added is pretty neat for visualizing the worst‑case scenario.

Courtney Winq-Microblading

June 7, 2025 AT 19:36Picture a forged document as a cracked mirror; it may reflect what you want to see, but the distortion eventually shatters the whole image of trust. Each legal charge is another fissure widening the break.

katie littlewood

June 12, 2025 AT 16:16It’s tempting to think that a single forged ID is just a minor hiccup, but the cascade effect is real. One charge opens the door to conspiracy allegations, which can pull in co‑conspirators you never imagined. The fines balloon especially when securities fraud is added, and the prison terms can stack, meaning you could be looking at decades. Plus, the stigma follows you even after serving time, limiting future job prospects and banking access. In the crypto world, you’ll find yourself blacklisted from most platforms. So before you even consider the shortcut, weigh the true cost against any fleeting advantage.

Jenae Lawler

June 17, 2025 AT 12:56While the punitive measures appear draconian, one must acknowledge the proportionality principle inherent in our jurisprudence; excessive penalties risk stifling innovation within the nascent digital asset sector.

Chad Fraser

June 22, 2025 AT 09:36Sure, but the law’s primary goal is to protect investors, not to impede progress. A balanced approach ensures both safety and growth.

Jayne McCann

June 27, 2025 AT 06:16Penalties are just numbers until someone actually gets caught.

Richard Herman

July 2, 2025 AT 02:56Let’s keep the discussion focused on factual consequences rather than speculation. Transparency helps everyone understand the real stakes.

Parker Dixon

July 6, 2025 AT 23:36Here’s a quick breakdown: 📄 Document forgery → up to 20 years, 💰 $250K fine; 📡 Wire fraud → same caps; 📈 Securities fraud → up to $5 M fine. Combine them and you’re looking at a massive legal exposure.

Stefano Benny

July 11, 2025 AT 20:16All these “max penalties” are theoretical ceilings; in practice, plea deals often slash the numbers drastically. 🤷♂️

Bobby Ferew

July 16, 2025 AT 16:56It’s just another headline, nothing changes the grind.

celester Johnson

July 21, 2025 AT 13:36The moral decay evident in forging documents reflects a deeper societal rot that cannot be remedied by mere fines.

Prince Chaudhary

July 26, 2025 AT 10:16I appreciate the detailed breakdown; it helps viewers make informed decisions without sensationalism.

John Kinh

July 31, 2025 AT 06:56Wow, a calculator for crimes-because who doesn’t love math with their misdemeanors? 😂

Mark Camden

August 5, 2025 AT 03:36It is incumbent upon every aspiring trader to uphold integrity; otherwise, the entire market collapses under deceit.

Evie View

August 10, 2025 AT 00:16People who think forgery is a clever hack are just delusional and dangerous.

Nathan Blades

August 14, 2025 AT 20:56When you sit down and examine the legal landscape surrounding document forgery for crypto exchange access, the first thing that jumps out is the sheer breadth of statutes that can be invoked. Document forgery on its own already carries a statutory maximum of twenty years in prison and a quarter‑million dollar fine, which is substantial for any individual. However, the moment that forged document is used to facilitate a wire transfer, you instantly add another layer of wire fraud, mirroring the same severe penalties. If the transaction involves securities, the Securities Exchange Act steps in, and the fines can soar up to five million dollars, dwarfing the earlier amounts. Money laundering statutes can also be triggered, imposing additional fines and potential imprisonment, often designed to strip the proceeds from illicit activity. Conspiracy charges further complicate matters, because prosecutors can argue that you acted in concert with others, extending prison terms to a range of five to twenty years. Each of these statutes is distinct, meaning they can be stacked rather than merged, creating a cumulative effect that can be financially ruinous. Moreover, the conviction carries collateral consequences: loss of professional licenses, travel bans, and a permanent stigma that follows you for life. In the crypto ecosystem, being flagged for fraud can result in immediate bans from exchanges, loss of access to wallets, and a black‑list that deters future partnerships. The emotional toll cannot be ignored either; the stress of legal battles, the uncertainty for family members, and the societal judgment are all heavy burdens. While some might argue that these harsh penalties chill innovation, the reality is that trust is the foundation of any financial system, and without it, markets cannot function. Therefore, the cost of forging documents far outweighs any short‑term gain you might envision. As a community, we should promote transparency, robust KYC processes, and education to prevent the temptation of shortcuts. Remember, the real freedom in crypto comes from building reputations based on honesty, not deception. Ultimately, the law serves as a deterrent, protecting both investors and the integrity of the digital asset space.

Somesh Nikam

August 19, 2025 AT 17:36Stay legit, stay safe.

Charles Banks Jr.

August 24, 2025 AT 14:16Sure, because adding a calculator to a crime page totally encourages people to break the law faster.