Portugal Crypto Tax Calculator

Calculate your capital gains tax in Portugal based on holding periods and current tax rules. This tool follows the 2025 regulations where long-term holdings (over 365 days) are tax-free, while short-term gains are taxed at 28% under Category G.

Portugal used to be the go-to place for crypto investors looking to avoid taxes. If you held Bitcoin for more than a year, you paid zero capital gains tax. If you earned staking rewards or got airdrops, you didn’t pay a cent. And if you moved there under the Non-Habitual Resident (NHR) program, your foreign income - including crypto gains - was completely tax-free. That was the dream.

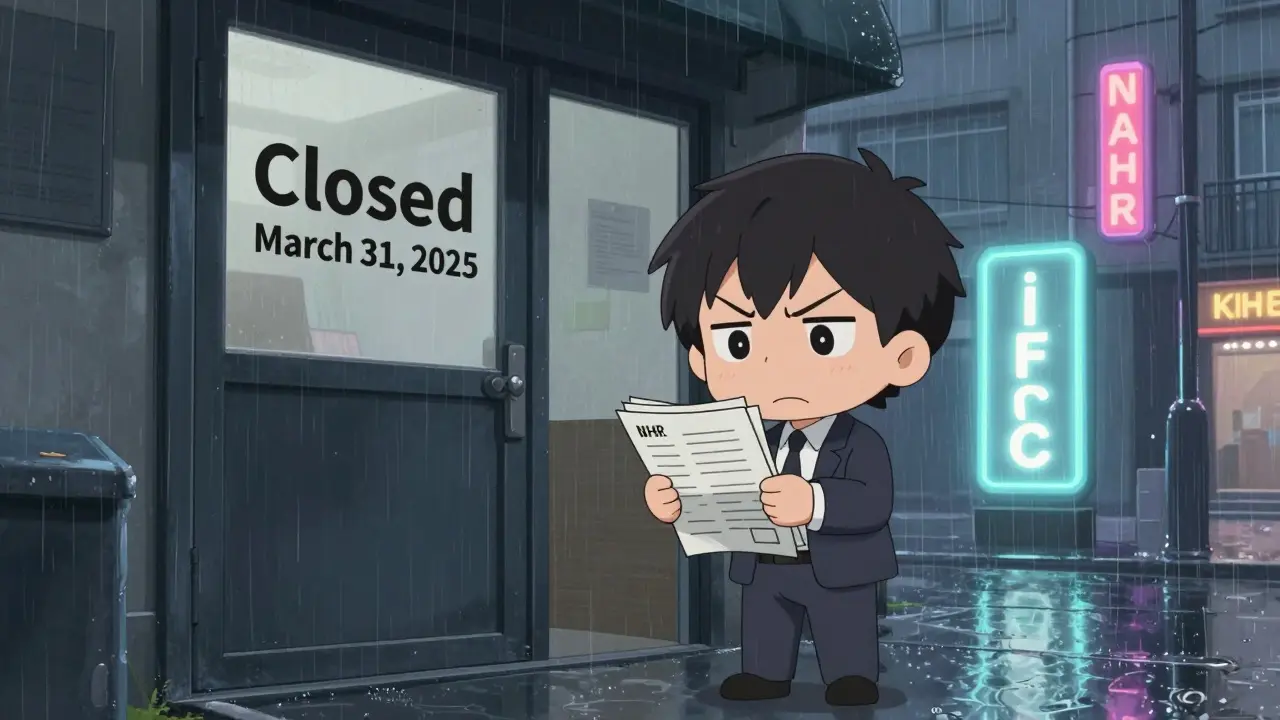

That dream ended on March 31, 2025. The original NHR program is gone. New applicants can’t sign up anymore. The government replaced it with something called IFICI - the Tax Incentive for Scientific Research and Innovation. And while it still offers some perks, it’s no longer a free pass for crypto traders.

What Happened to the NHR Program?

The NHR program started in 2009 to lure skilled workers, retirees, and investors to Portugal. It gave people a 10-year tax holiday: 20% flat tax on Portuguese income, and zero tax on most foreign income - including crypto. By 2023, over 14,850 people had signed up. About 1,800 of them were crypto or blockchain professionals.

But the government got worried. Too many people were using it just to avoid taxes, not to contribute to the economy. In October 2023, they announced NHR would close to new applicants. The final deadline? March 31, 2025. If you didn’t apply by then, you’re out.

Here’s the catch: if you got NHR status before that date, you keep your benefits for the full 10 years. So someone who applied in 2022 still gets zero tax on crypto gains until 2032. But if you moved to Portugal in 2025 after April 1, you’re in a whole new system.

Portugal’s Crypto Tax Rules in 2025 (IFICI Era)

Even without NHR, Portugal still has one of the most straightforward crypto tax systems in Europe. The rules are simple:

- Hold crypto for more than 365 days? No tax. Ever. This applies to buying, selling, or trading.

- Sell or trade within a year? You pay 28% capital gains tax under Category G.

- Staking, lending, airdrops? Also taxed at 28% - treated as income, not capital gains.

- Crypto-to-crypto trades? Not taxed at the time of trade. Only when you convert to euros or fiat.

That last point is huge. It means you can swap Bitcoin for Ethereum, then Ethereum for USDC, then cash out USDC to euros - and if you held each asset over a year, you pay nothing. This is called tax-loss harvesting, and it’s legal in Portugal.

But here’s the problem: IFICI doesn’t automatically give you the same crypto benefits as NHR did. IFICI is only for people in scientific research, tech development, or highly qualified professions. If you’re a full-time crypto trader who doesn’t run a blockchain startup or publish research papers, you likely don’t qualify.

Can You Still Get Tax Benefits Under IFICI?

Possibly - but only if you can frame your crypto activity as a “qualified profession.”

For example:

- You run a crypto analytics startup that uses AI to predict market trends - qualifies.

- You’re a blockchain developer building DeFi protocols - qualifies.

- You trade crypto full-time and make €150k a year - doesn’t qualify.

There’s no official list of approved jobs. The Portuguese Tax Authority (AT) decides case by case. Many applicants are getting rejected because they can’t prove their crypto work is “scientific” or “innovative.”

Some people try to get around this by registering as a freelance developer or consultant, even if they’re mostly trading. It’s risky. If the tax office audits you and finds you didn’t do any real development work, you could lose your status and owe back taxes - plus penalties.

What About U.S. Citizens?

If you’re an American, Portugal’s tax rules don’t matter much.

The IRS still taxes you on your worldwide income - no matter where you live. Even if Portugal says your crypto gains are tax-free, the IRS will still hit you with capital gains tax. And if you earned over $10,000 in crypto on exchanges, you had to file a FinCEN Form 114 (FBAR) and Form 8938.

Many Americans who moved to Portugal under NHR thought they’d escaped U.S. taxes. They didn’t. Now, with NHR gone, they’re stuck paying both countries - unless they renounce citizenship or use the Foreign Earned Income Exclusion (which doesn’t cover crypto gains).

Bottom line: Portugal won’t save you from the IRS. It only saves you from Portuguese taxes.

How to Prove Your Holding Period

Portugal doesn’t track your wallet addresses. The tax office doesn’t know if you held Bitcoin for 366 days or 364 days. That’s your job.

You need:

- Transaction history with exact dates and times

- Wallet addresses used for each trade

- Fiat value in euros at the time of purchase and sale

- Proof you owned the asset continuously (no gaps)

Use crypto tax software like Koinly or CryptoTaxAudit. They auto-import transactions from exchanges and wallets, calculate holding periods, and generate reports in Portuguese format. Most people who get audited lose because they used Excel spreadsheets or screenshots - the tax office doesn’t accept those.

Also, don’t forget: crypto-to-crypto trades reset the clock. If you bought Bitcoin in January 2024, swapped it for Ethereum in June 2024, then sold Ethereum in March 2025 - you only held Ethereum for 9 months. You’ll owe 28%.

Costs and Process to Get Tax Residency

To qualify for any tax benefit in Portugal, you need to become a tax resident. That means:

- Spending at least 183 days per year in Portugal, OR

- Proving you have a permanent home here and strong ties (bank account, lease, family, etc.)

You also need a Portuguese tax ID (NIF). Getting one is easy - you can do it online or in person at a tax office. But applying for IFICI? That’s harder.

Professional help costs between €1,200 and €2,500. That includes:

- Preparing your application

- Writing a justification letter for IFICI eligibility

- Translating documents

- Filing your first tax return

Processing time: 30 to 60 days. If you’re rejected, you can appeal - but most appeals fail without solid proof of professional activity.

How Portugal Compares to Other Countries in 2025

Portugal used to be #1 for crypto tax efficiency. Now it’s not even top 3.

| Country | Long-Term Capital Gains Tax | Staking/Lending Tax | Residency Requirement? | EU Compliance |

|---|---|---|---|---|

| Portugal | 0% (after 365 days) | 28% | Yes (for IFICI) | MiCA compliant |

| Germany | 0% (after 1 year) | Taxable as income | No | MiCA compliant |

| Switzerland | 0% (cantonal variation) | Taxable as income | No | MiCA compliant |

| Spain | 19-26% | 19-26% | Yes | MiCA compliant |

| France | 30% flat | 30% flat | Yes | MiCA compliant |

Germany and Switzerland now beat Portugal because you don’t need to live there to get the tax break. You just need to hold crypto for a year. Portugal requires you to move, prove residency, and jump through bureaucratic hoops - and even then, you might not qualify.

What’s Next for Portugal’s Crypto Tax Policy?

As of October 2025, the Portuguese government hasn’t clarified how IFICI applies to crypto. No official guidelines exist. That’s a problem.

But the EU’s MiCA regulations are now in force. All EU countries must regulate crypto service providers uniformly. Portugal is already adapting - exchanges like Binance and Kraken now report user data to the tax authority.

Industry analysts at Deloitte Portugal predict the holding period might extend from 365 to 730 days by 2027 to match EU trends. That would kill the current advantage.

For now, Portugal still offers one of the cleanest, most transparent crypto tax systems in Europe - if you’re already in the system. For new arrivals? The door is closed.

Who Should Still Consider Portugal?

If you’re a crypto investor thinking about moving to Portugal in 2025, here’s the truth:

- Don’t move if your only goal is tax-free crypto gains. You won’t qualify.

- Do move if you’re a developer, researcher, or founder. IFICI still gives you a 20% flat tax on Portuguese income - and you can still hold crypto long-term tax-free.

- Don’t move if you’re American. The IRS still owns your gains.

- Do move if you want EU residency, mild weather, and a simple tax system. Even with IFICI, Portugal beats Spain, France, or Italy.

People who moved before March 2025 are still winning. They’re paying 0% on crypto gains and living in Lisbon or Porto with low cost of living and great infrastructure. Those who waited? They’re stuck with 28% on short-term trades and no path to tax exemption.

Portugal didn’t become anti-crypto. It just stopped giving away tax breaks to people who didn’t contribute to the economy. If you’re here to build, not just cash out - you still have a place. If you’re here to hide money? You’re out of luck.

Can I still get tax-free crypto gains in Portugal in 2025?

Yes - but only if you held your crypto for more than 365 days. The 28% tax only applies to short-term trades. However, you must be a tax resident to benefit from this rule. New applicants under IFICI don’t automatically get crypto tax exemptions unless they qualify under the program’s strict professional criteria.

Is the NHR program still open for new applicants?

No. The original NHR program closed to new applicants on March 31, 2025. Only those who applied and were approved before that date keep their 10-year tax benefits. Everyone else must apply under the new IFICI regime, which has much stricter eligibility rules.

Do I need to live in Portugal full-time to get crypto tax benefits?

Yes. To qualify for any Portuguese tax benefits, including the 0% long-term crypto gain rate, you must become a tax resident. That means either spending 183 days or more in Portugal per year, or proving you have a permanent home and strong personal and economic ties to the country. You can’t be a tourist and claim tax exemptions.

Are crypto-to-crypto trades taxable in Portugal?

No - not at the time of the trade. Portugal doesn’t tax exchanges between cryptocurrencies. You only pay tax when you convert crypto into euros or fiat currency. This allows investors to swap assets without triggering a tax event, as long as they hold each asset for over a year before cashing out.

Can U.S. citizens avoid taxes by moving to Portugal?

No. The U.S. taxes its citizens on worldwide income regardless of where they live. Even if Portugal doesn’t tax your crypto gains, the IRS still will. U.S. citizens must report crypto transactions to the IRS and may owe capital gains tax, even if they’re living in Portugal under NHR or IFICI. Renouncing U.S. citizenship is the only way to fully escape this.

What documents do I need to prove my crypto holding period?

You need detailed transaction records: exact dates and times of purchases and sales, wallet addresses used, and the euro value of each transaction. Use crypto tax software like Koinly or CryptoTaxAudit to generate official reports. Screenshots, Excel sheets, or handwritten logs are not accepted by the Portuguese Tax Authority during audits.

Stanley Wong

December 7, 2025 AT 12:18So I moved to Lisbon last year thinking I’d be riding the crypto tax-free wave like some European Silicon Valley guru

Turns out I’m just another guy with a NIF and a wallet full of ETH that’s been sitting since 2022

My 10-year NHR clock started in 2021 so I’m golden till 2031 but man the vibe’s changed

Everyone’s either a blockchain dev or pretending to be one to get IFICI

I just trade and chill and now I feel like the odd one out at the co-working space

Still worth it though. Beaches are free and my taxes are zero

Just don’t tell the IRS I said that

Tom Van bergen

December 8, 2025 AT 08:28Portugal never gave a damn about crypto it just let rich Americans hide money

Now they’re waking up and realizing tax havens don’t build infrastructure

Germany and Switzerland don’t need you to move there to get the same benefit

Portugal’s system was always a loophole not a policy

And now the loophole’s patched

Good riddance to the free ride

Real innovators don’t need tax breaks they build things

Sandra Lee Beagan

December 9, 2025 AT 10:04As someone who moved here from Canada as a blockchain researcher I can say IFICI is brutal but fair

They want real innovation not just portfolio diversification

I spent weeks drafting my application with academic papers and open-source contributions

Got approved after 45 days

Now I pay 20% on my local income and 0% on my crypto gains

It’s not easy but if you’re building something meaningful it’s worth it

Don’t come here to hide come here to contribute

And use Koinly seriously your spreadsheets will get you audited 😅

Chris Jenny

December 10, 2025 AT 02:29THEY’RE LYING TO YOU!!!

THEY’RE NOT CLOSING NHR THEY’RE HIDING THE REAL TAXES BEHIND IFICI!!!

THE EU IS USING THIS TO TRACK EVERY WALLET ADDRESS!!!

THE IRS AND PORTUGUESE TAX OFFICE ARE SHARING DATA THROUGH A SECRET BACKDOOR IN MICA!!!

YOU THINK YOU’RE SAFE BUT THEY’RE ALREADY FLAGGING YOUR TRANSACTIONS!!!

THEY’LL COME FOR YOU IN 2027 WHEN THEY EXTEND THE HOLDING PERIOD TO 730 DAYS!!!

YOUR COINBASE ACCOUNT IS BEING MONITORED RIGHT NOW!!!

DON’T TRUST ANYONE WHO SAYS IT’S STILL SAFE!!!

THEY’RE JUST TRYING TO MAKE YOU THINK YOU HAVE TIME!!!

rita linda

December 11, 2025 AT 12:49Americans think they can just fly in, buy a villa, and avoid taxes like it’s a game

Portugal isn’t your offshore tax shelter it’s a country with laws

And now they’re finally enforcing them

If you’re here just to game the system you’re a parasite

Real contributors get IFICI

Everyone else gets taxed like normal people

It’s not complicated

Stop pretending this is a loophole

It was a gift and now the gift is over

Martin Hansen

December 11, 2025 AT 23:20Look I’m not here to judge but if you’re still trying to qualify for IFICI as a ‘crypto trader’ you’re delusional

They’re not dumb they know the difference between a developer and a day trader

I’ve seen 3 people get rejected this month because they listed ‘crypto trading’ as their profession

One guy even tried to say he was a ‘blockchain analyst’ because he followed CoinMarketCap

Bro

You can’t just rename your hobby and call it innovation

Either build something or pay 28%

It’s that simple

Lore Vanvliet

December 13, 2025 AT 10:26Okay but imagine if you’re American and you moved here under NHR thinking you were safe

Now you’re stuck paying US taxes AND Portuguese taxes on short trades

And you can’t even get IFICI because you don’t have a PhD in blockchain

And your wallet history is a mess because you used a sketchy exchange

And now you’re crying in a co-working space in Porto while someone else gets 0% because they built a DeFi protocol

That’s not justice

That’s a trap

And they let you walk into it

It’s not even a policy

It’s a bait and switch

Scott Sơn

December 13, 2025 AT 23:33Portugal used to be the crypto paradise

Now it’s the crypto purgatory

They took the velvet rope and replaced it with a metal detector

You still get the view but now you have to prove you’re not a tourist

I sold my BTC in 2023 before the deadline

Now I’m just here for the wine and the sun

And the fact that I didn’t get audited

But I know people who did

They’re still paying off penalties

So if you’re thinking of moving

Don’t come for the tax break

Come for the damn pastéis de nata

Frank Cronin

December 15, 2025 AT 13:45Let me get this straight

You moved to Portugal because you thought you could avoid taxes

And now you’re mad because the system finally caught up to you?

Wow

What a shock

It’s not that Portugal changed

It’s that you finally realized you were living off a lie

And now you want to cry because you didn’t plan ahead

Here’s a radical idea

Don’t move to a country to avoid responsibility

Move to build something

Or just stay home and pay your taxes like an adult

Ben VanDyk

December 16, 2025 AT 10:32Just a quick note on the holding period: if you do a crypto-to-crypto trade, the clock resets for the new asset

So if you bought BTC in Jan 2024 and swapped it for ETH in June 2024, then sold ETH in March 2025, you only held ETH for 9 months

That’s taxable

Many people miss this

And then get hit with 28% when they file

Use Koinly or CryptoTaxAudit

Don’t use Excel

Don’t use screenshots

Don’t wing it

It’s not worth the audit risk

Krista Hewes

December 18, 2025 AT 09:46so i just moved here in feb and i’m like oh cool maybe i can still get something

but then i read the ifici rules and i’m like… wait i just trade

no dev work no papers no startup

just me and my binance account

and now i feel kinda stupid

like i thought portugal was still the place

but turns out the dream ended

and i’m just here for the vibe

and the coffee

and the fact that i can still hold my crypto for a year and pay nothing

so maybe it’s not all bad

just not what i thought it was

Josh Rivera

December 19, 2025 AT 11:27Everyone’s acting like Portugal betrayed them

It didn’t

It just stopped being a tax haven for freeloaders

And guess what

That’s actually responsible governance

People who built real businesses still win

People who just bought BTC in 2021 and called themselves ‘investors’? You were never supposed to get a free pass

It’s not anti-crypto

It’s anti-free-ride

And honestly

Good for them

Neal Schechter

December 20, 2025 AT 04:10For anyone considering IFICI: don’t apply unless you have real proof of professional activity

That means contracts, invoices, GitHub commits, published research, client letters

Not a LinkedIn post saying ‘I’m a blockchain expert’

Portugal’s tax office has seen 500+ applications this year

80% got rejected for fluff

I helped 3 people get approved last month

One was a developer who built a smart contract audit tool

Another was a data scientist analyzing on-chain behavior

Third was a crypto education startup with paying clients

If you don’t have that kind of proof

Save your €2000 and just pay the 28%

It’s cheaper than the stress

Madison Agado

December 20, 2025 AT 13:30There’s something poetic about this

Portugal opened its doors to attract people who would enrich its culture

But too many came to extract value without giving anything back

So they closed the door

Not out of cruelty

But out of self-respect

It’s not about crypto

It’s about what kind of society you want to live in

One where everyone plays fair

Or one where the smartest people get to cheat

They chose the former

And honestly

It’s beautiful

jonathan dunlow

December 21, 2025 AT 02:32If you’re still thinking about moving to Portugal for crypto tax reasons

Let me tell you something

It’s not dead

It’s just evolved

Yes the NHR is gone

But if you’re a developer or researcher

You still get 20% on local income AND 0% on long-term crypto gains

That’s still better than 26% in Spain or 30% in France

And you get sunshine, beaches, and low cost of living

So don’t give up

Just pivot

Don’t come as a trader

Come as a builder

Because Portugal still rewards people who create

Not just people who cash out

Mariam Almatrook

December 21, 2025 AT 19:39It is my profound conviction that the dissolution of the NHR program represents a paradigmatic recalibration of fiscal sovereignty vis-à-vis transnational wealth migration

One cannot reasonably expect a sovereign state to perpetually subsidize the capital accumulation of non-resident actors under the guise of economic development

The IFICI framework, while administratively rigorous, constitutes a necessary epistemological correction to the prior rent-seeking ethos

One must not conflate tax optimization with value creation

And herein lies the moral imperative of this transition

Chris Mitchell

December 22, 2025 AT 13:09Portugal didn’t become anti-crypto

It became anti-free-loader

And that’s a good thing

If you’re here to build, you’re welcome

If you’re here to hide, you’re not

Simple as that

And if you’re American? Don’t even bother pretending

The IRS owns your gains

Portugal just doesn’t care

nicholas forbes

December 23, 2025 AT 16:55I’m glad they closed NHR

It was getting ridiculous

Too many people treating Portugal like a tax-free Airbnb

Now only people who actually contribute get the perks

And that’s fair

But I still think they should make IFICI easier to understand

Right now it’s like a maze

And if you’re not a lawyer or a consultant

You’re lost

So yeah

Good policy

Bad communication

Regina Jestrow

December 24, 2025 AT 10:19So I applied for IFICI last month

Got rejected

They said my ‘crypto trading’ wasn’t ‘innovative’

But I have a YouTube channel with 12k subs

And I’ve written 40 blog posts on DeFi

Isn’t that knowledge sharing?

They said no

So now I’m thinking of becoming a freelance web dev

Just so I can get IFICI

And then keep trading on the side

Is that wrong?

Or just… realistic?

Cristal Consulting

December 25, 2025 AT 17:51Just a heads up for anyone reading this

Don’t forget the 183-day rule

Even if you have IFICI

If you’re not physically here enough

You lose residency

And then you lose the 0% crypto benefit

One girl I know moved here in January

Went back to the US for 4 months for family stuff

Got audited

Lost her status

Now owes back taxes

Don’t be her

Keep your days counted

And keep your lease active

Thomas Downey

December 26, 2025 AT 07:57Let me be blunt

Portugal is no longer a tax haven

It’s a middle-class European country with decent rules

And if you came here expecting to be a crypto billionaire without paying anything

You were never meant to be here

It’s not your fault

It’s just the truth

And the sooner you accept it

The sooner you can start building something real

Or go back home

Either way

Stop pretending

ronald dayrit

December 28, 2025 AT 02:34Here’s the thing nobody talks about

Even if you qualify for IFICI

You still have to file taxes every year

And you still have to prove your crypto holdings

And you still have to pay for a Portuguese accountant

And if you’re American

You have to file with the IRS too

So you’re paying €2500 to get a 0% rate

But you’re still doing double the paperwork

And if you get audited

You’re on your own

So ask yourself

Is it worth it?

Or are you just chasing a fantasy?

Doreen Ochodo

December 28, 2025 AT 02:42Portugal’s still amazing

Just not for tax dodgers

But if you’re a dev, a designer, a writer, a researcher

It’s still the best place in Europe to live and work

Low cost

Great weather

Good internet

And if you hold crypto for a year

You pay 0%

So yes

It’s not the free-for-all it was

But it’s still a win

Just don’t come here to hide

Come here to live

Yzak victor

December 28, 2025 AT 04:17my friend got nhr in 2022

he’s still paying 0% on his btc

he’s not a dev

he just moved here before the deadline

and now he’s living in a 300 year old house in the algarve

drinking port wine

and laughing at all of us who waited too long

so if you’re thinking about it

don’t wait

but if you’re already too late

don’t stress

just pay the 28%

and enjoy the sun

Martin Hansen

December 28, 2025 AT 08:04That’s the thing about Portugal

They don’t care if you’re rich

They care if you’re useful

And if you’re just a trader with a wallet full of ETH

You’re not useful

You’re a tourist with money

And they’re done letting tourists write their own rules