Crypto Trading Fee Calculator

Compare Trading Costs in North Macedonia

See how fees impact your crypto purchases using real-world data from North Macedonia's underground market.

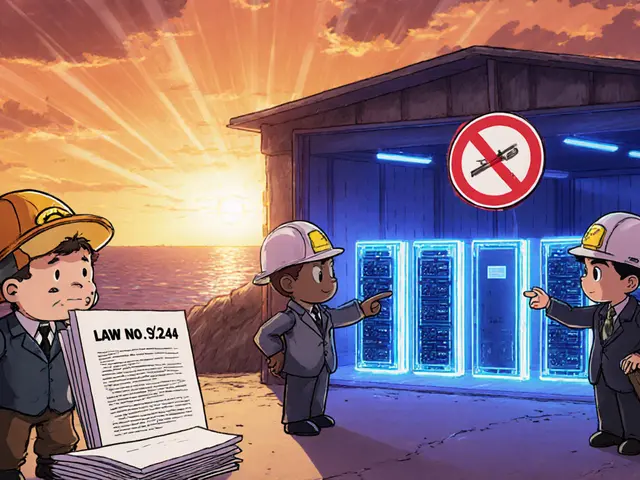

North Macedonia has one of the strangest crypto stories in Europe. On paper, trading Bitcoin or Ethereum is illegal. The National Bank of the Republic of Macedonia banned it back in 2017, calling it equivalent to foreign securities trading - something citizens weren’t allowed to do under EU association rules. But if you walk through Skopje or Bitola today, you’ll find people buying Bitcoin with cash in parking lots, trading USDT over WhatsApp, and using apps like Symlix and LocalCoinSwap to swap crypto without banks.

This isn’t a glitch. It’s a system that works - barely - because the government stopped enforcing the ban years ago. No one’s been arrested. No exchanges have been shut down. Instead, a quiet underground market grew, fed by young people tired of low wages, high inflation, and banks that won’t touch crypto. Today, an estimated 42,000 people in a country of 1.8 million trade crypto regularly. That’s more than 2% of the population - and growing fast.

How the Ban Actually Works (Or Doesn’t)

The 2017 ban wasn’t meant to stop crypto forever. It was a temporary rule tied to North Macedonia’s path toward EU membership. At the time, the country was still in the first phase of its Stabilisation and Association Agreement with the EU, which blocked citizens from investing in foreign securities. Since crypto looked like a foreign asset, it got lumped in. But in 2022, everything changed.

On February 1, 2022, the government passed new anti-money laundering laws that for the first time legally defined “virtual assets,” “crypto wallets,” and “virtual asset service providers.” That didn’t make crypto legal - but it did something more important: it admitted crypto existed. The National Bank quietly shifted its stance. In 2023, they said: “It doesn’t mean cryptocurrencies are illegal if they are not regulated.” Translation? We’re not going to chase you down for buying Bitcoin… yet.

So now you have a legal gray zone. The old ban is still on the books. But no one’s prosecuting traders. Meanwhile, international brokers like Swissquote and Interactive Brokers openly accept Macedonian clients. CoinGecko still calls North Macedonia “the only European country where cryptocurrencies are explicitly illegal.” But that’s like calling a house with no electricity “off the grid” - it’s technically true, but nobody lives there anymore.

The Underground Networks: Symlix, LocalCoinSwap, and Cash Meetups

There are no official crypto exchanges in North Macedonia. But there are dozens of unofficial ones - all peer-to-peer.

Symlix.com is the most popular. It’s a P2P marketplace where users trade Bitcoin, Ethereum, and USDT. You pick a seller, agree on a price, and send cash via bank transfer, PayMaya, or even in person. The platform holds your crypto in escrow until the seller confirms they got paid. If something goes wrong, their support team steps in. They say they resolve 85% of disputes within 24 hours.

LocalCoinSwap works the same way - but with over 300 payment methods. You can trade using mobile top-ups, gift cards, Western Union, or even PayPal (though that’s risky). Users filter trades by location, so you can find someone in your city. Many prefer cash meets. You meet in a busy café, show your ID, and hand over euros or denars. The seller releases the crypto once they verify the cash.

These trades aren’t perfect. There are scams. But the community has built its own safety rules:

- Always use escrow - never send crypto before payment

- Start with small amounts - €50 or less - to test a trader

- Meet in public places - never at home

- Use video calls to verify identity before large trades

Telegram groups like “MK Crypto” have over 1,200 members. They share lists of trusted traders, warn about fake payment screenshots, and even map out safe meetup spots in Skopje. One user posted a photo of a parking garage near the main train station where 12 people traded crypto last weekend. No police. No problems.

Why People Use International Brokers Like Swissquote

Some traders skip P2P entirely and go straight to regulated brokers. Swissquote, Interactive Brokers, and MultiBank all accept North Macedonian clients. You can link your local bank account, buy Bitcoin, and hold it in their wallets.

But there’s a catch: fees are brutal. Swissquote charges up to 4% per trade. For a €1,000 Bitcoin purchase, that’s €40 in fees alone. Interactive Brokers has lower fees - around 1.5% - but offers only a handful of coins and no built-in crypto wallet. You have to move your Bitcoin to an external wallet, which adds another layer of complexity.

Trustpilot reviews from Macedonian users show a pattern: 7 out of 12 praise “reliable transactions,” but 9 complain about “high fees for small amounts.” One user wrote: “I bought €200 worth of ETH. After fees, I got €182. That’s not investing - that’s paying to play.”

For small traders, P2P wins every time. You can buy Bitcoin for €1,000 and pay just €5 in fees - or even zero if you find a direct cash trade. The risk? Slower. The reward? More money in your pocket.

The Real Danger: Regulatory Whiplash

The biggest threat isn’t scammers. It’s the government.

There’s no guarantee the 2017 ban won’t be enforced tomorrow. One day, the National Bank could decide to crack down. Banks could freeze accounts. P2P platforms could disappear overnight. People could lose everything.

That’s why experienced traders don’t keep large amounts on exchanges or in wallets linked to their real names. They use cold wallets. They split holdings across multiple addresses. They avoid large bank transfers. One user on Reddit described how €1,200 got frozen for two weeks after he tried to deposit crypto earnings into his local account. He had to prove the money came from a P2P trade, not a scam. He won - but it took weeks.

TRT World’s 2025 report captured the mood: “Many are concerned. There are no clear laws.” Experts warn that people don’t understand how crypto works - and that’s true. Most users in North Macedonia learned from YouTube videos and Telegram groups. Few know about private keys, gas fees, or tax implications.

There’s no official tax guidance. The government hasn’t said if crypto profits are taxable. Most people don’t report them. But if regulation comes, back taxes could be due. That’s a ticking clock.

What’s Next? The Road to Regulation

Everyone agrees the current situation can’t last. The EU’s Markets in Crypto-Assets (MiCA) law will apply to North Macedonia once it becomes a member - likely between 2026 and 2027. The government knows this. That’s why they passed the 2022 AML law. It wasn’t to ban crypto. It was to prepare for it.

According to Multilaw’s 2024 legal update, draft legislation is expected by late 2025. It will likely require P2P platforms to register, verify users, and report suspicious activity. That could mean the end of anonymous cash trades. It could also mean legal protection for traders.

For now, the underground market thrives because it fills a real need. Wages are low. Inflation is high. Banks are slow. Crypto offers a way out - even if it’s risky. And as long as people keep trading, the government will keep looking the other way.

One thing is certain: North Macedonia won’t stay in this gray zone forever. The question isn’t whether regulation is coming. It’s whether the system will adapt - or collapse - when it does.

Roshan Varghese

November 20, 2025 AT 09:29Anthony Demarco

November 21, 2025 AT 02:16Lynn S

November 21, 2025 AT 19:31Chris G

November 23, 2025 AT 10:21Tim Lynch

November 24, 2025 AT 08:01Melina Lane

November 25, 2025 AT 04:19andrew casey

November 26, 2025 AT 09:49Lani Manalansan

November 26, 2025 AT 16:35Frank Verhelst

November 27, 2025 AT 16:38Dexter Guarujá

November 28, 2025 AT 21:30Jennifer Corley

November 30, 2025 AT 02:14Natalie Reichstein

December 1, 2025 AT 19:22Kaitlyn Boone

December 2, 2025 AT 20:08James Edwin

December 3, 2025 AT 13:34Kris Young

December 4, 2025 AT 16:36LaTanya Orr

December 5, 2025 AT 09:54Ashley Finlert

December 5, 2025 AT 21:00Chris Popovec

December 7, 2025 AT 13:41Marilyn Manriquez

December 9, 2025 AT 09:58taliyah trice

December 10, 2025 AT 15:42