DeFi Composability Explorer

The ability for different blockchain protocols to work together seamlessly, like LEGO blocks snapping together to create complex structures.

- Smart Contracts

- Token Standards (ERC-20/721)

- APIs & SDKs

Build your own DeFi composition by selecting components:

Your DeFi Composition:

- Rapid innovation

- Capital efficiency

- Network effects

- Security cascades

- Transaction complexity

- Regulatory uncertainty

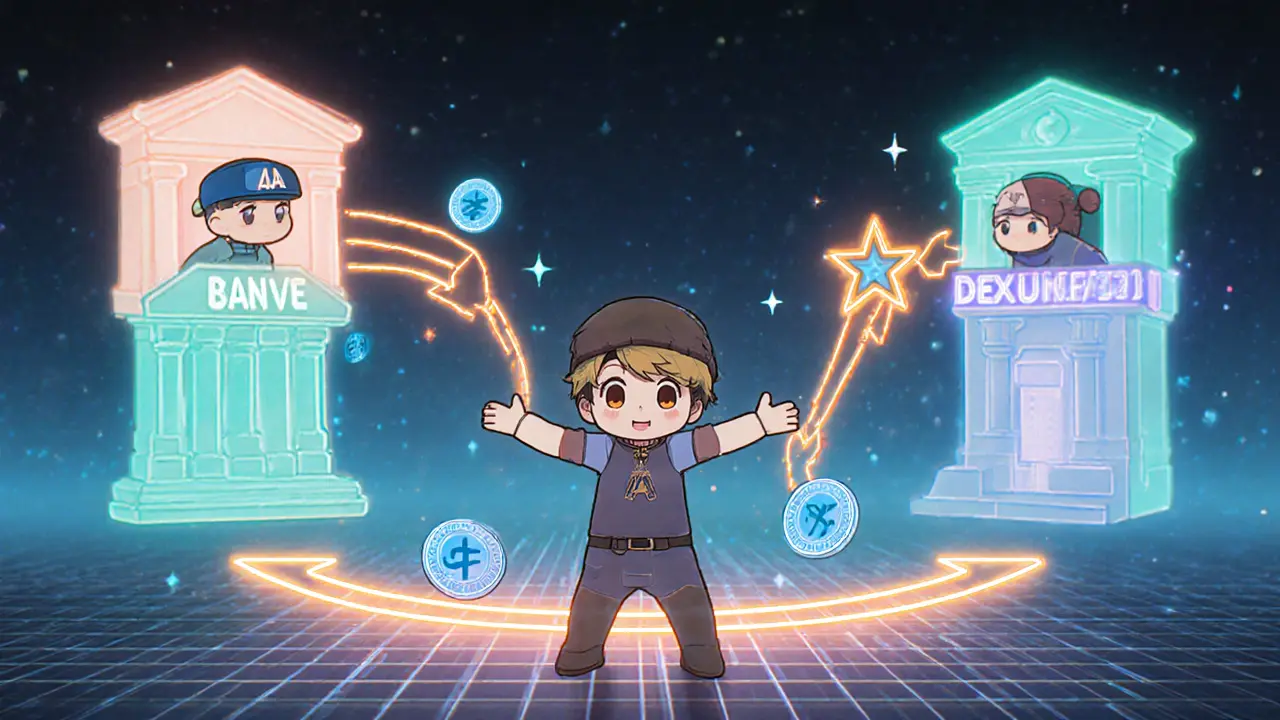

Ever wonder why new DeFi apps seem to pop up overnight, each adding a fresh twist to borrowing, trading, or earning? The secret sauce is DeFi composability - the ability for different blockchain pieces to snap together like LEGO bricks, creating endless financial combos.

Composability is the architectural principle that lets blockchain protocols, smart contracts, and APIs connect and interact without friction. In the world of decentralized finance, this means one protocol’s output can instantly become another’s input, powering everything from flash‑loan arbitrage to automated yield farming.

Money Legos: The DeFi Analogy That Clicks

Think of each DeFi protocol as a colorful LEGO block. DeFi a collection of open‑source financial services built on blockchains supplies the base plates, while smart contracts act as the pegs that lock pieces together. Because the blocks follow common standards - mainly token standards - developers can mix‑and‑match them without needing a permission slip.

Core Building Blocks Behind the Magic

Three technical pillars make composability possible:

- Smart contracts self‑executing code on the blockchain that automates interactions provide the glue that executes cross‑protocol logic.

- ERC‑20 the most common token standard for fungible assets and ERC‑721 the standard for non‑fungible tokens guarantee that tokens can move freely between apps.

- APIs and SDKs pre‑built interfaces that expose protocol functions to developers standardize how apps talk to each other.

Specific protocol types add functional depth:

- Lending protocols platforms that let users borrow or supply assets for interest (e.g., Aave, Compound).

- Decentralized exchanges on‑chain marketplaces for swapping tokens directly (e.g., Uniswap, SushiSwap).

- Flash loans unsecured loans that must be repaid within a single transaction, enabling instant arbitrage.

How Composability Works in Practice

When a developer wants to build a new product, they follow three steps:

- Identify compatible protocols independent DeFi services that expose standard interfaces (e.g., a lending pool and a DEX).

- Use the API/SDK of each protocol to fetch state data-like interest rates or asset balances.

- Write a smart contract that orchestrates calls across the chosen protocols in a single atomic transaction so the whole operation either succeeds or reverts.

This atomicity eliminates the need for trust between services because the blockchain guarantees that all steps happen together.

Why Developers and Users Love It

- Rapid innovation: Instead of building a lending engine from scratch, a project can reuse Aave’s pool and focus on the new user experience.

- Capital efficiency: Funds can be deployed across multiple platforms at once, maximizing yield without moving assets manually.

- Network effects: The more protocols that expose clean interfaces, the richer the ecosystem becomes, creating a virtuous cycle.

Risks That Come With Interconnectedness

Interoperability is a double‑edged sword. If a single protocol is exploited, the breach can ripple through every app that relies on it. This systemic risk shows up in three ways:

- Security cascades: A vulnerability in a lending contract may allow attackers to drain collateral from downstream derivatives.

- Transaction complexity: Multi‑step operations increase gas costs and raise the chance of a single call failing, which reverts the whole transaction.

- Regulatory gray zones: Because composable apps blend services (trading, borrowing, insurance), regulators struggle to classify them.

Best practices include thorough audits, formal verification of cross‑protocol logic, and building fail‑safe fallback paths.

Real‑World Examples of Money Legos in Action

Here are three popular DeFi products that wouldn’t exist without composability:

- Yield optimizers smart contracts that automatically shift assets between lending platforms to chase the highest APR (e.g., Yearn Finance).

- Flash‑loan arbitrage bots scripts that borrow large sums, exploit price differences across DEXs, and repay in a single block.

- Synthetic asset protocols systems that combine price oracles, collateral managers, and token minting to create on‑chain replicas of stocks or commodities (e.g., Synthetix).

Composable vs. Traditional Finance (and Monolithic DeFi)

Traditional finance requires legal contracts, intermediaries, and often long integration cycles. In contrast, composable DeFi offers permissionless, instant stitching of services.

| Dimension | Composable DeFi | Traditional / Monolithic DeFi |

|---|---|---|

| Integration barrier | Permissionless, code‑level APIs | Legal agreements, onboarding delays |

| Capital efficiency | Assets reused across multiple protocols | Capital locked in single institutions |

| Innovation speed | New product built in days | Months to years for rollout |

| Systemic risk | Risk propagation between contracts | Risk isolated within regulated entities |

Future Trends Shaping Composability

Developers are already extending the Lego concept beyond a single chain:

- Cross‑chain composability: Bridges and relay networks let an Ethereum‑based lending pool interact with a Solana DEX.

- Layer‑2 scaling: Optimistic and zk‑Rollups lower gas fees, making multi‑protocol transactions economically viable.

- Standardized frameworks: Initiatives like the Interoperable DeFi Specification aim to codify common interfaces.

- Better security tooling: Formal verification suites now target multi‑contract workflows, reducing hidden attack vectors.

Regulators are watching closely, as the seamless blend of services challenges existing compliance frameworks. Expect more sandbox programs and AML‑focused primitives designed for composable environments.

Key Takeaways

- Composability is the modular, permissionless glue that lets DeFi protocols talk to each other.

- Smart contracts, token standards (ERC‑20/721), and open APIs are the core technical enablers.

- Benefits include rapid product launches, higher capital efficiency, and strong network effects.

- Risks involve security cascades, transaction complexity, and regulatory uncertainty.

- Future growth will be driven by cross‑chain bridges, layer‑2 solutions, and stricter security tooling.

Frequently Asked Questions

What does “money legos” mean in DeFi?

It’s a nickname for composability - each protocol is a Lego brick that can be snapped together with others to build new financial products without starting from scratch.

How do flash loans illustrate composability?

A flash loan borrows funds from a lending pool, uses them in a single transaction to trade on a DEX, and repays the loan instantly. All steps are coordinated by one smart contract that talks to two different protocols.

Can composable DeFi be secure?

Security is possible but requires rigorous audits, formal verification of cross‑protocol calls, and monitoring for cascade failures. Many projects now run bug‑bounty programs specifically for composable contracts.

What’s the difference between ERC‑20 and ERC‑721 in composability?

ERC‑20 tokens are interchangeable (like dollars) and are ideal for liquidity‑focused apps. ERC‑721 tokens are unique (like collectibles) and let composable platforms add non‑fungible assets such as NFTs to lending or insurance products.

Will cross‑chain composability replace bridges?

Cross‑chain composability still relies on bridges, but newer relay designs aim to make those connections trust‑minimized and faster, enabling seamless Lego‑style building across multiple ecosystems.

Stefano Benny

April 17, 2025 AT 20:13While everyone hails DeFi composability as the next big thing 🚀, the reality is a bit more layered 🤔. The term hides a cascade of interoperability protocols, atomic swaps, and layer‑2 scaling tricks that aren’t always plug‑and‑play. You’ll often see smart contracts calling other contracts in a single transaction, which sounds cool until the gas bill spikes. Yet the modularity does unlock rapid product iteration, so don’t throw the baby out with the bathwater.

Bobby Ferew

April 25, 2025 AT 22:40The buzz around money legos can feel a little overwhelming, especially when the jargon starts to drown out the actual utility. I find myself sighing at how quickly hype can eclipse thoughtful risk assessment. Still, the underlying mechanics-ERC‑20 standards, API gateways, and composable smart contracts-do offer a promising foundation.

MARLIN RIVERA

May 4, 2025 AT 01:06This whole composability hype is a textbook case of shiny‑object syndrome. Developers are stitching together fragile contracts like a hastily built bridge over a canyon, and when one piece fails, the whole structure collapses. It’s a risky game that rewards shortcuts over rigorous security audits.

Debby Haime

May 12, 2025 AT 03:33Whoa, love how the article breaks down the Lego analogy-makes the tech feel accessible! 🚀 If more devs keep building on top of solid foundations, we’ll see a wave of innovative products that actually help users earn and save. Keep the momentum going, community!

emmanuel omari

May 20, 2025 AT 06:00In Nigeria we have a vibrant DeFi scene that leverages composability to overcome traditional banking barriers. By chaining lending protocols with decentralized exchanges, our local innovators are achieving capital efficiency that rivals any Western platform. It’s a testament to how open‑source finance can empower emerging markets.

Andy Cox

May 28, 2025 AT 08:26Nice overview the post gives on how protocols can talk to each other it helps newbies see the big picture

Courtney Winq-Microblading

June 5, 2025 AT 10:53Imagine each protocol as a brushstroke on a canvas, each interacting to paint a richer financial masterpiece. The synergy isn’t just technical; it’s almost poetic, weaving together liquidity, risk, and opportunity into a living tapestry.

katie littlewood

June 13, 2025 AT 13:20Honestly, the concept of composable DeFi feels like assembling a gigantic puzzle where every piece matters. When you line up lending pools with DEXes and flash‑loan modules, the possibilities become almost endless. It’s exciting to watch projects iterate so quickly, though it does demand careful design. The community thrives on shared standards, which is why ERC‑20 remains the lingua franca. Let’s keep collaborating to push the boundaries while staying vigilant about security.

Jenae Lawler

June 21, 2025 AT 15:46While the enthusiasm for composability is undeniable, a rigorous academic critique is necessary. The premise that all protocols can interoperate seamlessly overlooks systematic vulnerabilities inherent in cross‑contract calls. Moreover, the regulatory ambiguities introduced by multi‑layered interactions warrant a more sober evaluation.

Chad Fraser

June 29, 2025 AT 18:13Great points! Let’s keep building on these ideas and make sure we test everything thoroughly. If we all share best practices, the ecosystem will stay strong and innovative.

Jayne McCann

July 7, 2025 AT 20:40That’s just not always true.

Richard Herman

July 15, 2025 AT 23:06It’s fascinating to see how composability can democratize finance, but we also need to stay grounded and prioritize security audits. Open collaboration across borders will only help us mature faster.

Parker Dixon

July 24, 2025 AT 01:33DeFi composability is basically the LEGO set of the crypto world, and if you look closely the pieces start to speak in an almost poetic rhythm 🚀. Every protocol exposes an API like a tiny hand reaching out for a neighbor's block, ready to snap together in a single transaction 🤝. This atomicity means you can borrow, trade, and repay without ever leaving the chain, which slashes trust requirements to near zero 🔐. Developers love this because they can focus on UI/UX while re‑using the heavy‑lifting smart contracts that already exist 🛠️. From a capital efficiency standpoint, assets can be leveraged across multiple platforms at once, amplifying yields without extra capital outlay 📈. Yield optimizers such as Yearn Finance are the perfect illustration, as they continuously hop between Aave, Compound, and Curve to chase the best APR 🔄. Flash‑loan arbitrage bots are another wild example, pulling thousands of dollars from a lending pool, exploiting price differences on Uniswap and SushiSwap, and settling the loan in the same block ⚡. Because all these steps are orchestrated by a single composable contract, the whole operation either succeeds or reverts, protecting users from half‑completed trades 🛡️. However, this interconnectedness also creates a security cascade; a bug in one protocol can cascade through every downstream app that depends on it 🐞. Recent exploits on DeFi bridges have shown how a single vulnerable contract can drain funds across multiple layers 🌊. The transaction complexity also ramps up gas costs, making some strategies only viable when the network is cheap ⛽. Regulators are still trying to figure out how to classify these multi‑protocol products, which adds legal uncertainty for developers ⚖️. Cross‑chain composability is on the horizon, with projects building bridges that let Ethereum‑based lending talk to Solana DEXes 🌉. Layer‑2 solutions like Optimism and zk‑Rollups are reducing the cost barrier, making multi‑step transactions economically feasible for ordinary users 💡. All in all, composability is the engine powering DeFi's rapid innovation, but it demands rigorous audits and defensive coding to keep the ecosystem safe 🛎️.

celester Johnson

August 1, 2025 AT 04:00The allure of seamless protocol integration can feel almost intoxicating, a siren song that promises boundless efficiency. Yet beneath that glitter lies a precarious web where a single flaw can unravel the entire tapestry. One must ask whether the pursuit of composability is driven by genuine utility or merely the thrill of technical wizardry. In the end, the greatest risk is our collective hubris, assuming we can master complexity without humility.

Prince Chaudhary

August 9, 2025 AT 06:26Stay focused on building robust fail‑safes and thorough testing; a solid foundation will protect the entire composable stack.

John Kinh

August 17, 2025 AT 08:53Wow, another hype cycle-guess we’ll see how long it lasts 🤷♂️.

Mark Camden

August 25, 2025 AT 11:20It is incumbent upon the community to foster a culture of disciplined development, wherein every composable contract is subject to comprehensive audits. Without such rigor, we risk perpetuating systemic vulnerabilities that could undermine confidence in the entire ecosystem.

Evie View

September 2, 2025 AT 13:46The sheer audacity of some projects to ignore proven security practices is infuriating; we must demand accountability and enforce standards now.

Sidharth Praveen

September 10, 2025 AT 16:13Keep pushing forward-your optimism fuels real progress in this space.

Sophie Sturdevant

September 18, 2025 AT 18:40When you’re wiring together lending pools and DEXs, make sure you embed proper re‑entrancy guards and gas‑limit checks. Using industry‑standard patterns reduces the attack surface dramatically.

Nathan Blades

September 26, 2025 AT 21:06Watch how the narrative unfolds: each new composable layer adds drama to the saga of decentralization, and with each act we learn more about resilience and innovation.

Somesh Nikam

October 4, 2025 AT 23:33Great insights! Let’s continue sharing knowledge and building responsibly 🌟. Together we can shape a safer, more vibrant DeFi future.