PVARA Crypto Exchange Eligibility Checker

Check Your Eligibility

Before you apply for a PVARA crypto exchange license in Pakistan, verify if your company meets the basic requirements.

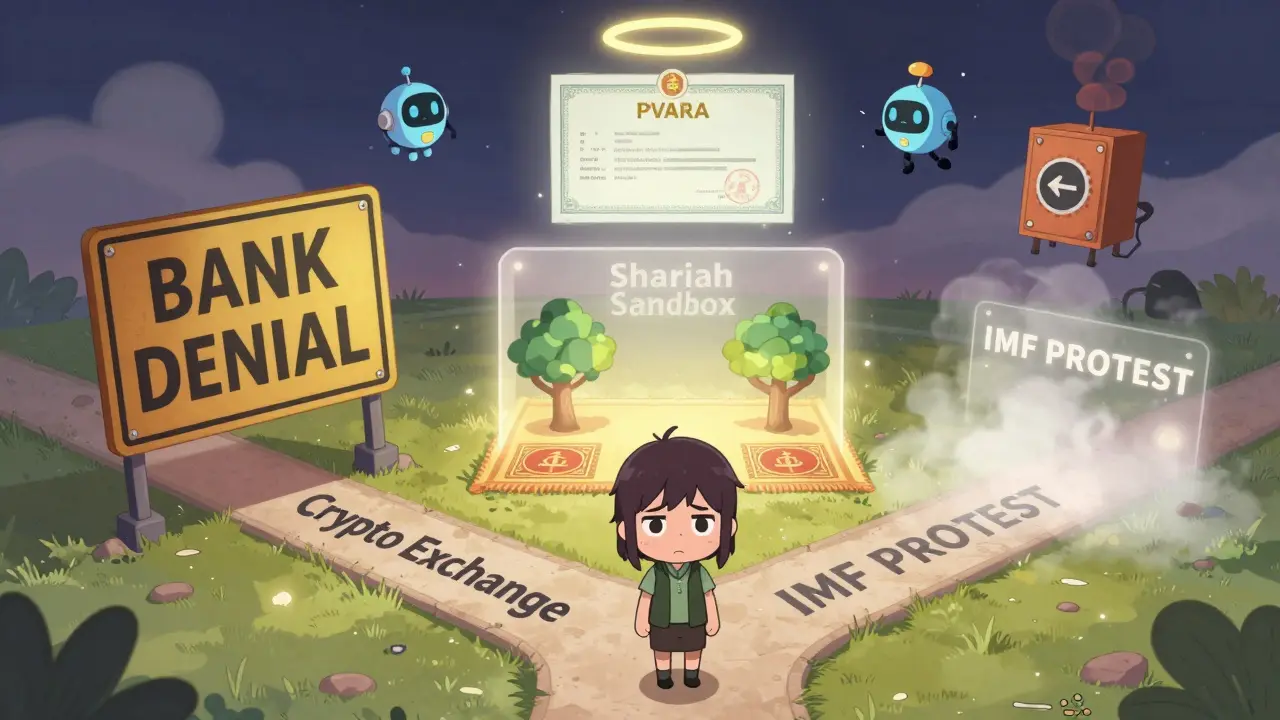

Before July 2025, owning or trading cryptocurrency in Pakistan was a legal gray zone. Banks blocked transactions, regulators stayed silent, and users operated in the shadows. Then came the PVARA licensing framework - a sudden, sweeping shift that turned Pakistan from a crypto-restrictive country into one of the most structured markets in South Asia. But here’s the catch: it’s not as simple as applying for a license. The rules are strict, the bureaucracy is layered, and the contradictions are real.

Who Can Apply for a Crypto Exchange License in Pakistan?

You can’t just start a crypto exchange in Pakistan and hope for the best. The Pakistan Virtual Asset Regulatory Authority (PVARA) only accepts applications from companies that are already licensed by top-tier international regulators. That means if you’re based in the U.S., you need SEC approval. If you’re in the UK, you need FCA authorization. UAE? VARA. Singapore? MAS. The EU? You need to be registered under its VASP framework. This isn’t about size or revenue. It’s about track record. PVARA wants proven players - firms that have survived audits, passed AML checks, and kept their systems secure for years. A new startup from a country with weak oversight won’t make the cut. The goal? Keep out the scammers and attract the serious players.What Documents Do You Need to Submit?

The application isn’t a form you fill out online. It’s a 50-page dossier. Every detail matters. Here’s what you must include:- Full company profile - ownership structure, board members, headquarters location

- Copy of your current license from your home regulator, with official stamp and validity dates

- Detailed breakdown of services: trading, custody, staking, payments, tokenization

- Technology stack - how you secure private keys, prevent hacks, handle DDoS attacks

- Assets under management (AUM) and revenue figures from the last three fiscal years

- Proof of AML/CFT compliance - your internal policies, staff training records, transaction monitoring tools

- KYC procedures - how you verify users, what ID documents you accept, how you handle high-risk clients

- A Pakistan-specific business plan - how you’ll onboard local users, handle rupee conversions, comply with local tax rules

The Three-Month Wait - Why So Long?

PVARA doesn’t process applications in batches. They review them one by one, on a rolling basis. That means if you submit in January, you might get a response in April. If you submit in June, you’re still waiting in July. Why the delay? Because PVARA is doing deep due diligence. They’re not just checking paperwork. They’re verifying your regulator’s credibility. They’re cross-referencing your AML logs with FATF databases. They’re contacting your past auditors. They’re even checking if your CEO has any ties to sanctioned entities. The minimum wait time is three months. That’s not a suggestion - it’s the baseline. Many applicants take longer. Some get rejected after 120 days. Others get requests for additional documents and have to restart parts of the process.The Contradiction: PVARA vs. State Bank of Pakistan

Here’s the biggest hurdle no one talks about: PVARA says crypto is legal. The State Bank of Pakistan says it’s not. PVARA is the new kid on the block, created by the Virtual Assets Ordinance 2025. It has the power to issue licenses, enforce rules, and approve exchanges. But the State Bank of Pakistan - the country’s central bank - still holds the keys to the banking system. And it hasn’t changed its stance: banks cannot process crypto-related transactions. No deposits. No withdrawals. No fiat on-ramps. This creates a nightmare for exchanges. You can get your license from PVARA, but if you can’t connect to a bank, how do users deposit Pakistani rupees? How do you pay employees? How do you settle taxes? Analysts call this a paradox. Users call it confusing. Some exchanges are working around it by partnering with offshore payment processors. Others are waiting for the central bank to blink. Until that happens, the licensing process feels like getting a driver’s license - but being told you can’t drive on any roads.Shariah-Compliant Crypto Is the Secret Weapon

Pakistan is 96% Muslim. That’s not just a cultural fact - it’s a business opportunity. PVARA has created regulatory sandboxes specifically for Shariah-compliant crypto products. That means exchanges can apply to offer halal staking, tokenized zakat platforms, or blockchain-based Islamic savings accounts. No interest. No speculation. No gambling. Just asset-backed, transparent, and ethical digital finance. This isn’t just marketing. It’s a real regulatory pathway. Several firms from Malaysia and Indonesia are already in talks with PVARA to launch Shariah-compliant exchanges in Pakistan. If you’re building a crypto product and you’re unsure how it fits into Islamic finance, PVARA offers pre-application consultations. It’s one of the few places in the world where you can get official guidance on halal crypto.What Happens After You Get Licensed?

Getting the license isn’t the end - it’s the beginning. Licensed exchanges must:- Submit quarterly compliance reports to PVARA

- Undergo annual on-site audits

- Keep all user data stored within Pakistan’s borders

- Report any suspicious transactions within 24 hours

- Pay annual licensing fees based on transaction volume

The Bigger Picture: Mining, CBDCs, and the IMF

PVARA’s licensing push is part of a larger, controversial strategy. At Bitcoin Vegas 2025, Pakistan announced plans for a Strategic Bitcoin Reserve and 2,000 MW of subsidized electricity for mining. The IMF pushed back hard - calling it fiscally reckless and environmentally unsustainable. The mining plan is still on hold. But the central bank is quietly preparing a pilot for its own Central Bank Digital Currency (CBDC). That’s telling. The government wants digital money - it just can’t decide if it should be decentralized or controlled. Meanwhile, the Senate is moving to shift crypto oversight from Finance to Information Technology. Why? Because digital assets are seen as tech, not finance. That change could reshape how PVARA operates in the future.Who Should Even Try This?

If you’re a small crypto startup from India or Bangladesh, forget it. You won’t qualify. If you’re a U.S.-based exchange with SEC approval and a clean compliance record - this is your chance. Pakistan’s 240 million people are hungry for digital finance. Remittances alone are worth $30 billion a year. That’s a market no legitimate player can ignore. But be ready. The paperwork is brutal. The wait is long. The banking problem is unsolved. And the rules can change tomorrow.What’s Next?

The first licenses are expected to be issued by October 2025. Only a handful will get through - maybe five or six. But once the first exchange goes live, everything changes. Users will start moving. Banks will feel pressure. The State Bank will have to respond. This isn’t just about crypto. It’s about Pakistan’s place in the global digital economy. Will it become a hub for compliant, Shariah-compliant digital finance? Or will bureaucracy and contradiction kill it before it starts? The answer is still being written. But if you’re serious about entering this market, you need to act now - and do it right.Can I start a crypto exchange in Pakistan without an international license?

No. PVARA only accepts applications from firms already licensed by recognized regulators like the SEC, FCA, MAS, or VARA. Local startups without international credentials are not eligible.

How long does the PVARA licensing process take?

The minimum processing time is three months, but it can take longer depending on document completeness and regulatory review depth. PVARA reviews applications on a rolling basis, not in batches.

Can I use Pakistani banks to deposit rupees for crypto trading?

No. The State Bank of Pakistan still prohibits banks from handling crypto-related transactions. Licensed exchanges must use offshore payment processors or alternative settlement methods to move fiat currency.

Are Shariah-compliant crypto products allowed in Pakistan?

Yes. PVARA has created regulatory sandboxes specifically for Islamic finance-compliant crypto services, including halal staking, tokenized zakat, and blockchain-based savings products.

What happens if my crypto exchange violates PVARA rules?

Violations can lead to fines, suspension of operations, or full license revocation. PVARA also publicly names non-compliant exchanges, which damages reputation and user trust.

Is Bitcoin mining legal in Pakistan?

The government proposed a 2,000 MW mining initiative, but the IMF rejected it due to fiscal and grid concerns. As of now, large-scale mining is not officially approved or operational under any regulatory framework.

Do I need to store user data inside Pakistan?

Yes. Licensed exchanges must store all user data - including KYC documents and transaction records - on servers located within Pakistan’s borders to comply with data localization rules.

Can I apply for a license if my company is based outside Pakistan?

Yes. PVARA welcomes international VASPs. However, you must demonstrate a clear plan to serve the Pakistani market, including local compliance, customer support, and rupee settlement solutions.

Shane Budge

December 5, 2025 AT 14:49So PVARA wants SEC/FCA-approved firms only? That’s just gatekeeping with a Pakistani flag.

Real innovation dies before it starts.

Barb Pooley

December 6, 2025 AT 19:54They’re gonna license crypto exchanges but banks can’t touch rupees? Sounds like a government scam to me.

They want the tax revenue but not the responsibility. Classic.

Chris Jenny

December 8, 2025 AT 02:09Wait… the IMF rejected mining? Of course they did.

They’ve been controlling Africa’s economy since the 70s, and now they’re scared of decentralized money? Hah!

They don’t want you to be free - they want you to depend on their digital dollar.

And now Pakistan’s being told what to do by a bunch of suits in Washington? No way.

This isn’t regulation - it’s colonization with a spreadsheet.

They’re terrified because crypto removes their power.

And they’re using ‘fiscal responsibility’ as an excuse to keep the poor poor.

They don’t care about the environment - they care about control.

They’d rather see 240 million people stuck in poverty than let them own their own money.

Don’t fall for it.

They’re not stopping mining because it’s ‘unstable’ - they’re stopping it because it’s unstoppable.

And if you believe the State Bank’s ban? You’re still sleeping.

Wake up.

This is the real revolution.

Uzoma Jenfrancis

December 8, 2025 AT 22:33Why should a foreign company get to run crypto in Pakistan?

We have our own tech talent. Our own engineers. Our own youth.

They’re letting Wall Street in while our startups get ignored.

This isn’t progress - it’s surrender.

And now they want us to store data locally? Fine.

But why not let Pakistani companies apply too?

It’s not about security.

It’s about who gets to profit.

Vincent Cameron

December 8, 2025 AT 23:59The real question isn’t whether Pakistan can regulate crypto - it’s whether it can reconcile its own contradictions.

One arm of government says: ‘Here’s a license.’

The other says: ‘No bank accounts.’

That’s not policy - that’s cognitive dissonance on a national scale.

We’re building a highway… but refusing to let cars drive on it.

And then we wonder why no one shows up.

Regulation without infrastructure isn’t governance - it’s theater.

And theater doesn’t feed families.

It doesn’t move remittances.

It doesn’t empower the unbanked.

It just looks good on a press release.

Tara Marshall

December 10, 2025 AT 16:40Shariah-compliant crypto is the smartest move here.

It’s not just cultural - it’s strategic.

Malaysia and Indonesia are already ahead.

Pakistan has a real shot to lead the Islamic fintech space.

Focus on that, and the rest follows.

Nelson Issangya

December 11, 2025 AT 04:24Let me tell you something - this is HUGE.

Pakistan has a chance to be the first Muslim-majority country to get crypto right.

Not just compliant - visionary.

Shariah crypto, data localization, global standards - this isn’t just a license.

This is a legacy.

Stop complaining about the bureaucracy.

Start building.

They’re not waiting for you.

They’re waiting for someone brave enough to show up.

Be that person.

Joe West

December 11, 2025 AT 23:12Just a heads-up - if you’re applying, make sure your AML logs are spotless.

PVARA cross-checks with FATF.

I’ve seen companies get rejected over one missing training record.

Also - no ZIPs. Seriously. They’ll bounce it.

PDF only. Subject line exact.

Small stuff kills big dreams here.

jonathan dunlow

December 13, 2025 AT 17:18Look, I know this sounds like a nightmare - 50 pages, three-month wait, no banking, the IMF breathing down your neck - but let’s zoom out.

This isn’t just about crypto.

This is about Pakistan deciding whether it wants to be part of the digital future or stuck in the analog past.

Every single person who’s ever sent money home from the Gulf or Europe? They’re waiting for this.

Every college kid trying to buy Bitcoin without a middleman? They’re waiting.

Every woman in Lahore who wants to invest but can’t open a brokerage account? She’s waiting.

And yes, the bureaucracy is brutal.

And yes, the State Bank is being stubborn.

But if you’re smart, you don’t fight the system - you work around it.

Use offshore processors.

Partner with fintechs in Dubai.

Build your Shariah-compliant product first.

Get your license.

Then make the banks beg you to work with them.

Because once one exchange goes live?

Everything changes.

Trust me - I’ve seen it happen before.

This isn’t the end of the road.

This is the start of the climb.

And the view from the top? Worth every sleepless night.

Chris Mitchell

December 14, 2025 AT 21:59License without banking is like a driver’s license with no roads.

But the real win? Shariah crypto.

That’s the bridge.

Not just compliance - cultural alignment.

That’s how you win hearts.

Then the money follows.

nicholas forbes

December 15, 2025 AT 12:33I get why PVARA is strict.

But if they’re going to demand international licenses, shouldn’t they also offer fast-track support for local partners?

Just saying.

There’s a difference between security and exclusion.

Regina Jestrow

December 16, 2025 AT 10:24Wait - so you can get a license but can’t deposit rupees?

That’s like getting a restaurant permit but being told you can’t serve food.

Who’s even running this country?

And why is no one asking why the State Bank is still blocking everything?

Is this a policy… or a power play?

Stanley Wong

December 16, 2025 AT 18:07I think the real story here isn’t the licensing rules - it’s the quiet shift in mindset.

Pakistan’s government is finally treating digital assets like infrastructure, not a threat.

Even if the banking part is broken right now, the fact that they created PVARA at all? That’s huge.

It means they’re thinking long-term.

They’re not just reacting to Bitcoin.

They’re trying to build a system.

And that’s something most countries haven’t even started doing.

So yeah, it’s messy.

But it’s moving.

And that’s more than I can say for most places.

Brooke Schmalbach

December 17, 2025 AT 02:49Let’s be real - this entire framework is a PR stunt designed to appease the IMF while secretly letting crypto flourish under the radar.

PVARA is a fig leaf.

The State Bank’s ban is the real policy.

They’re creating a regulatory theater so they can say ‘we’re progressive’ while keeping the system locked down.

And the Shariah-compliant sandbox? That’s just a Trojan horse to let foreign firms in under the guise of ‘cultural sensitivity.’

They’re not protecting Islamic finance - they’re protecting their own control.

Don’t be fooled.

This isn’t innovation.

This is illusion.

Manish Yadav

December 18, 2025 AT 15:20How can you allow crypto when it’s haram?

Trading is gambling.

Bitcoin is not backed by anything.

It’s a sin.

And now Pakistan wants to license it?

What kind of nation are we becoming?

Our Prophet warned us about uncertainty in trade.

And now we’re building temples to this digital idol?

Shame on PVARA.

Shame on the government.

Repent before it’s too late.

Madison Agado

December 20, 2025 AT 06:47The contradiction between PVARA and the State Bank isn’t a flaw - it’s a feature.

It forces innovation.

It forces people to build outside the system.

And sometimes, that’s how real change happens.

When institutions fail, people build alternatives.

That’s how Bitcoin started.

That’s how PayPal started.

That’s how every revolution begins - with a gap.

Don’t see the contradiction as a failure.

See it as the opening.

Tisha Berg

December 20, 2025 AT 11:05As someone who’s worked with Islamic fintech in Southeast Asia - this is a golden opportunity.

Shariah crypto isn’t just about religion.

It’s about ethics.

Transparency.

Trust.

And Pakistan has the population, the faith, and now the framework to lead this.

Don’t let the banking issue scare you.

Start small.

Build a zakat platform.

Let people see how it works.

The rest will follow.

And when it does?

Pakistan won’t just be a market.

It’ll be a model.

Roseline Stephen

December 20, 2025 AT 18:05Just wanted to say - if you’re applying, make sure your Pakistan business plan is detailed.

Not just ‘we’ll serve users’ - show how you’ll handle tax reporting, local support hours, rupee liquidity.

PVARA cares about sustainability.

Not just tech.

Jon Visotzky

December 21, 2025 AT 01:03So we’re gonna have licensed exchanges but no bank access?

And the IMF hates mining?

And Shariah crypto is the only way forward?

Man… this is wild.

But honestly?

It’s kind of beautiful.

Like a puzzle with half the pieces missing.

Someone’s gotta figure it out.

Why not us?