XTV (XTV) isn't a revolutionary blockchain project. It doesn't have a team, a whitepaper, or a use case beyond being traded. It's a meme coin built on Solana, and if you're wondering what it is, the short answer is: XTV is a high-risk, low-liquidity token that exists almost entirely because people believe it might go up - not because it does anything meaningful.

How XTV Actually Works (Or Doesn't)

XTV runs on the Solana blockchain using the SPL token standard. That means it’s not its own blockchain. It’s just a digital file that lives on Solana, like a digital trading card. Its only real function is to be bought and sold. There are no smart contracts for staking, no DeFi apps built around it, no NFTs, no games, no marketplace. Just a ticker symbol: XTV.

It has a fixed supply of 10 million tokens. Around 9.99 million are in circulation. The rest? Locked up or burned - no one knows for sure. What we do know is that the price moves wildly. As of early 2026, it’s hovering around $0.0035. That sounds cheap, but don’t let that fool you. A low price doesn’t mean it’s a good deal. It just means it’s easy to buy a million tokens with $3,500 - and then have no way to sell them.

Why XTV Exists: Community Over Code

Most cryptocurrencies are built to solve a problem. Bitcoin for peer-to-peer money. Ethereum for smart contracts. XTV? It was built to be a joke. A digital inside joke that got out of hand. It’s part of a growing category called "meme coins," where social media hype replaces technical innovation.

XTV’s entire identity is tied to online communities - mostly Telegram groups and Reddit threads. There’s no official website. The domain that should belong to XTV redirects to a generic token listing page. The Twitter account @XTVtoken hasn’t posted since June 2024. The only "development" you’ll find are random claims from anonymous admins saying "XTV to $0.10 by 2025" - which is about as reliable as a lottery ticket.

There are no audits. No security reviews. No public roadmap. Just a token with a name, a logo, and a few thousand people on Telegram who believe in it.

The Numbers Don’t Lie: Liquidity Is a Nightmare

Here’s where XTV falls apart in practice. Trading volume? Around $230 per day. That’s less than what a single large trade on Bitcoin moves in seconds. For comparison, Dogecoin moves over $300 million daily. XTV’s market cap? Roughly $42,000. That’s less than the cost of a modest apartment in Perth.

Why does this matter? Because when you try to sell your XTV, you’re competing with almost no buyers. Exchanges like Raydium and Jupiter list it, but the order books are paper-thin. Users report slippage of 40% or more - meaning if you try to sell 10,000 XTV, you might only get half the value you expected. One Reddit user said they tried to sell 500,000 XTV and lost nearly half their investment just from slippage.

And liquidity? It’s been stripped. According to blockchain analysis, 89% of the initial liquidity pool was removed within 30 days of launch. That’s a classic rug pull pattern. The people who created the token likely sold everything early and walked away. The remaining holders are left holding a token with no buyers.

Price Performance: A One-Way Trip Down

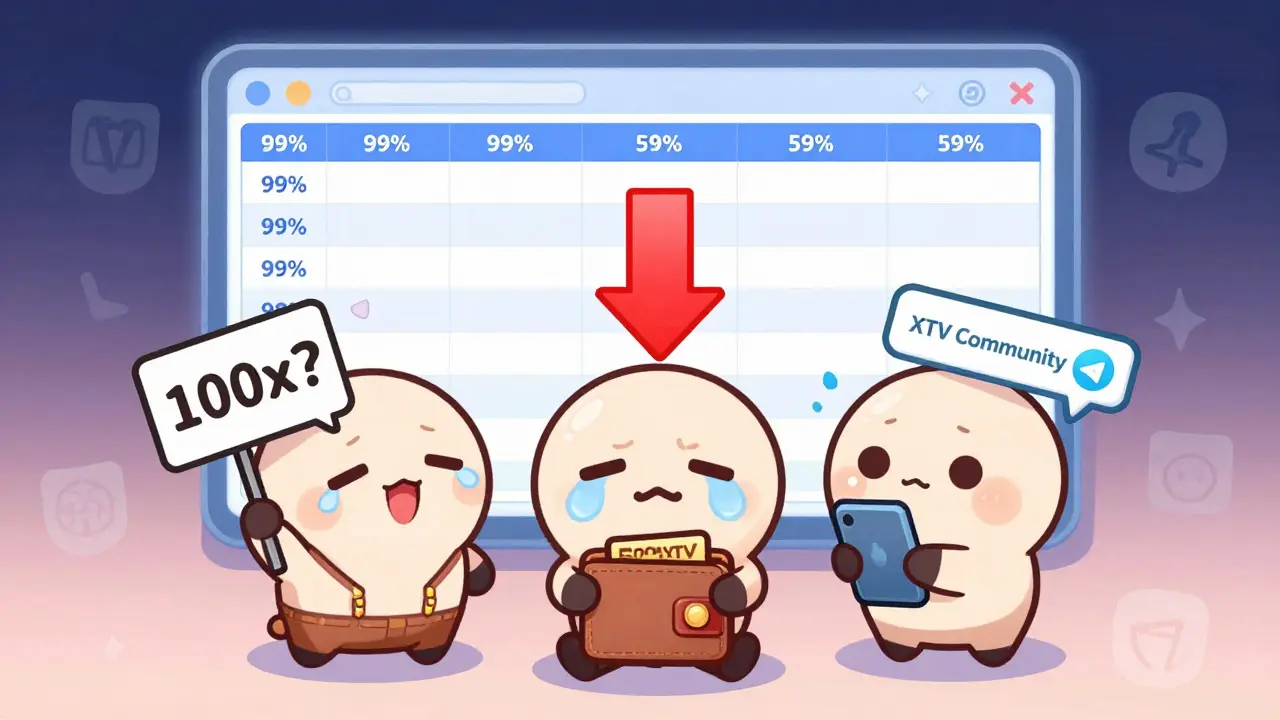

XTV hit its all-time high of $0.0054 - but that was months ago. Since then, it’s lost over 35% of its value. Monthly returns? Down 45%. Quarterly? Down 66%. It’s not just stagnant - it’s collapsing.

Technical indicators confirm the bearish trend. The 14-day RSI is at 43 - below neutral. The 50-day moving average is $0.0040, and the 200-day is $0.0072. That means the long-term trend is clearly downward. CoinCodex gives it a "Bearish" rating and predicts another 25% drop. Even the "Fear & Greed Index" for XTV is at 56 (Greed), which is odd - because the data says it’s dying. That gap tells you everything: people are clinging to hope, not facts.

How XTV Compares to Other Meme Coins

| Token | Market Cap | 24h Volume | Utility | Team Transparency |

|---|---|---|---|---|

| XTV | $42,140 | $232 | None | Anonymous |

| BONK | $1.4 Billion | $180 Million | DeFi, NFTs, Rewards | Known team |

| WIF | $2.9 Billion | $320 Million | Staking, DEXs, Ecosystem | Known team |

| SOL | $120 Billion | $3.1 Billion | Smart contracts, payments | Known team |

XTV isn’t just behind - it’s in a completely different league. BONK and WIF have real ecosystems. They have apps, wallets, rewards, and active developers. XTV has nothing. It’s not even close. And while Dogecoin and Shiba Inu have millions of followers and merchant acceptance, XTV has 2,341 people on Telegram. That’s not a community. That’s a chat room of hopeful gamblers.

Is XTV a Scam?

It’s not labeled as a scam by regulators - because it’s too small to be worth their time. But everything about it screams "high-risk gamble." No team. No utility. No liquidity. No transparency. A price that’s been falling for months. And a community that thrives on promises, not progress.

The SEC has warned about tokens like this: "No discernible utility, anonymous teams, manipulated liquidity." That’s XTV in a nutshell. It’s not illegal - but it’s as close to a financial trap as you can get without being outright fraud.

Who Still Buys XTV?

People who don’t understand crypto. People who see a $0.003 price and think "it can only go up." People who got sucked in by a Telegram post saying "100x potential." They’re not investors. They’re speculators. And they’re playing a game where the house always wins.

There’s no data to suggest XTV will recover. No development. No news. No partnerships. The only "news" is fake rumors - like a supposed integration with Solana Mobile Stack that never happened. That single rumor briefly spiked volume to $1,200. Then it vanished. That’s how this works.

Final Verdict: Don’t Buy XTV

XTV isn’t an investment. It’s not a technology. It’s not even a meme with staying power. It’s a ghost token - a digital shadow with no substance. If you’re thinking about buying it, ask yourself: why? What’s your plan? How will you sell? Who’s buying?

The answer to all three? You don’t know. And that’s the problem.

There are thousands of crypto projects out there. Some are bad. Some are good. XTV is in a category all its own: the graveyard. 92% of tokens with a market cap under $50,000 disappear within a year. XTV is already there. It’s just waiting to be forgotten.

Is XTV a real cryptocurrency?

Yes, technically - it exists as an SPL token on the Solana blockchain. But it has no utility, no team, and no long-term value. It’s not a currency in any meaningful sense. It’s a speculative asset with almost no liquidity.

Can I make money trading XTV?

You might make money if you buy at the bottom and sell before the next crash - but that’s pure luck. With daily volume under $300 and slippage often over 40%, it’s nearly impossible to exit a position without massive losses. Most people who trade XTV lose money.

Is XTV listed on Binance or Coinbase?

No. XTV is only listed on three exchanges: Raydium, Jupiter, and MEXC. None of them are major platforms. You won’t find it on Binance, Coinbase, or Kraken. That’s a red flag - legitimate projects get listed on top exchanges.

Why is XTV’s price so low?

Because there’s no demand. No utility. No community. No development. The low price reflects zero confidence from the market. It’s not "cheap" - it’s worthless. A $0.003 token with a $42,000 market cap is like a $100 bill with a hole in it - the number looks good, but it’s not usable.

Should I invest in XTV?

No. Not unless you’re prepared to lose everything. XTV has no roadmap, no team, no liquidity, and no future. It’s one of the riskiest assets in crypto. Experts agree: tokens like this are gambling, not investing. Save your money for projects with real use cases.

What to Do Instead

If you’re interested in Solana-based tokens, look at projects with actual adoption: Bonk, WIF, or even SOL itself. Check their development activity, their GitHub commits, their community size, and their exchange listings. If a token has no public team, no documentation, and no trading volume, walk away. XTV is a warning sign - not an opportunity.

Richard Cooper

February 19, 2026 AT 13:40