If you're trying to trade crypto on Kraken and got blocked, you're not alone. Thousands of users hit a wall when they try to log in or deposit funds - not because of a technical glitch, but because Kraken has blocked jurisdictions in place. These aren't random decisions. They're legal requirements, enforced to avoid fines, lawsuits, and losing their licenses. As of 2025, Kraken restricts trading in at least 14 countries entirely and adds dozens more with partial bans - including specific states in the U.S., privacy coins in Australia, and stablecoins in Europe.

Full Country Bans: Where Kraken Doesn't Operate At All

Kraken won't let anyone from these 14 countries create an account or trade anything:- Afghanistan

- Belarus

- Russia (including Crimea, Donetsk, and Luhansk)

- Iran

- Iraq

- North Korea

- Syria

- Libya

- Sudan

- South Sudan

- Democratic Republic of the Congo

- Cuba

- Central African Republic

- Eritrea

U.S. Restrictions: It's Not Just the Country - It's the State

The U.S. is Kraken's biggest market, but it's also its biggest headache. Federal rules allow Kraken to operate, but individual states have their own crypto laws. Here’s what you can’t do if you live in certain states:- New York: No trading at all unless you’re pre-approved through a special application. Most users never get approved.

- Washington State: Also blocked for new accounts. Existing users can withdraw but can’t deposit or trade.

- New Hampshire and Texas: You can’t hold or trade Euros (EUR) on Kraken. If you try to deposit EUR, it gets rejected.

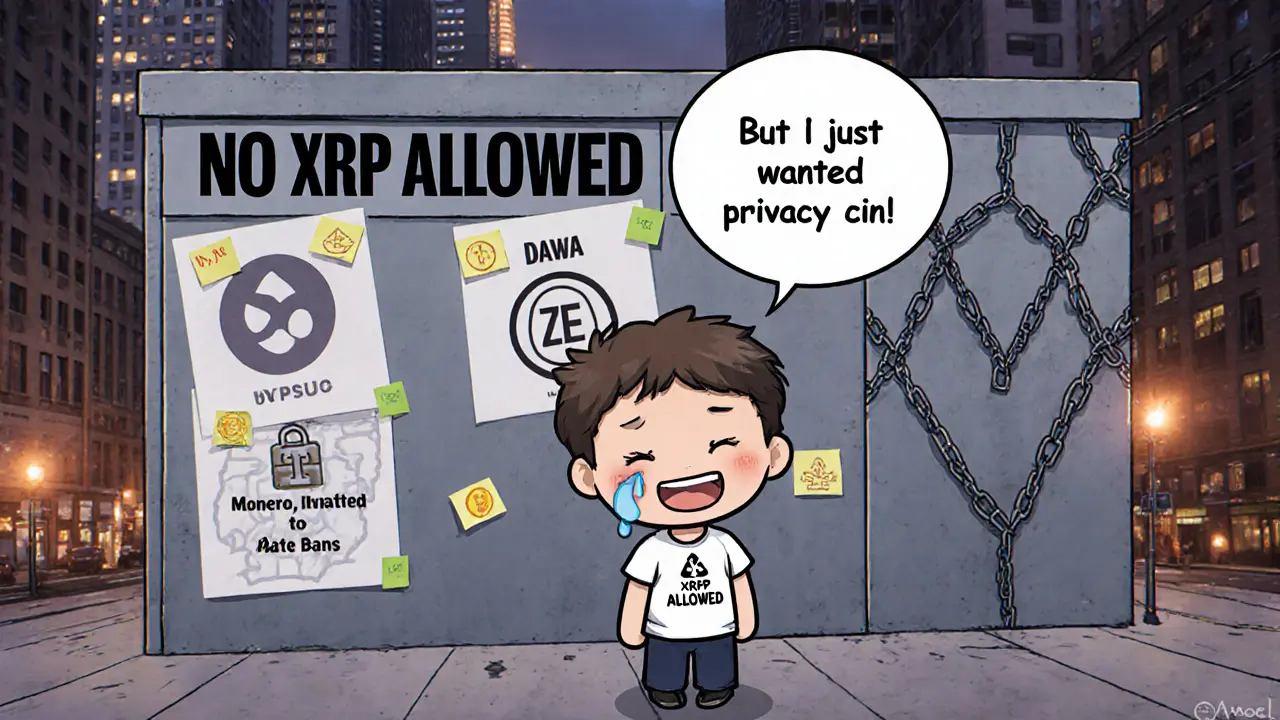

- All 50 states: XRP trading is completely banned. This is because of the SEC’s 2020 lawsuit against Ripple. Even though the case was later partially dismissed, Kraken kept the ban to avoid legal risk.

Australia and Japan: Privacy Coins Are Out

Australia’s financial watchdog, AUSTRAC, demands strict anti-money laundering controls. Kraken complied by banning all privacy coins for Australian users:- Monero (XMR)

- DASH

- Zcash (ZEC)

Europe’s Big Shake-Up: Stablecoins Are Gone

In early 2025, Kraken pulled the plug on five major stablecoins across the European Economic Area - a move that shocked even seasoned traders. The affected coins:- Tether (USDT)

- PayPal USD (PYUSD)

- TrueUSD (TUSD)

- Tether EURt (EURT)

- TerraClassic USD (USTC)

- February 13, 2025: Reduce-only mode (you could sell, but not buy)

- February 27, 2025: Sell-only mode (no new positions)

- March 17, 2025: Margin positions closed

- March 24, 2025: Spot trading stopped

- March 31, 2025: All remaining balances converted to EUR or USD

How Kraken Knows Where You Live

Kraken doesn’t guess. It uses multiple layers to verify your location:- IP Address: Your internet connection’s location is checked on login.

- ID Verification: Government-issued ID (passport, driver’s license) must match your address.

- Proof of Residence: Utility bills or bank statements sent in - must be recent and match your ID.

- Transaction Monitoring: If you suddenly start trading from a different country, alerts trigger.

Why Kraken Is So Strict - And Why It Matters

Kraken isn’t being difficult for the sake of it. It’s been fined before. In 2022, the U.S. Treasury fined them $30 million for violating sanctions. In 2021, the CFTC hit them for unapproved margin trading. The 2023 SEC lawsuit (later dropped) almost shut them down. Since then, Kraken has gone all-in on compliance. They’re the first crypto exchange to get a U.S. banking license (Wyoming’s SPDI charter). They’re licensed in the UK, Canada, Australia, and Japan. That’s rare. Most exchanges avoid these costly licenses. Kraken paid for them - and now they’re using them as armor. The trade-off? You lose access to some coins, some countries, and some features. But you also get:- Stronger fund security

- Legal protection for your assets

- Access to institutional investors

- Long-term stability

What’s Next for Kraken’s Restrictions?

Kraken isn’t done changing. Here’s what’s likely coming:- Washington and New York: Kraken is in talks with regulators to lift the ban. No timeline yet, but it’s possible by late 2026.

- Staking: They’re working to relist ETH2.S for direct trading - not just staking - if the SEC changes its stance.

- Europe: If MiCA allows more stablecoin issuers to get licensed, Kraken may bring back USDT. But that could take years.

- Global Expansion: Kraken is quietly applying for licenses in Singapore, Switzerland, and the UAE. If approved, they’ll open service there - with full compliance.

Can I use Kraken if I live in a blocked country but have a passport from a permitted country?

No. Kraken verifies your current residence - not your citizenship. If you live in Russia, Iran, or any other blocked country, your account will be blocked regardless of your passport. The system checks your IP, billing address, and ID documents. Attempting to bypass this with a VPN or fake documents leads to permanent account closure.

Why can’t I trade XRP on Kraken even though the SEC lawsuit was dropped?

Even though the SEC’s case against Ripple was partially dismissed in 2023, Kraken kept the XRP trading ban to avoid future legal risk. The SEC still considers XRP a security in many contexts, and Kraken doesn’t want to risk another lawsuit. This is a precaution, not a legal requirement - but for Kraken, the cost of one lawsuit outweighs the revenue from XRP trading.

What happens to my USDT if I live in Europe and Kraken delisted it?

If you held USDT on Kraken after March 31, 2025, your balance was automatically converted to either EUR or USD based on the market rate at the time. You can withdraw the converted amount, but you can no longer buy, sell, or trade USDT on Kraken. You’ll need to use another exchange like Binance or Bybit if you want to hold USDT in Europe.

Can I still stake ETH on Kraken if I’m in the U.S.?

Yes, but only through Kraken’s staking service - not direct trading. U.S. users can’t trade ETH2.S (the tokenized version of staked ETH), but they can stake their ETH directly and earn rewards. The rewards are paid in ETH, and you can withdraw them after the Ethereum network upgrade. This is the only way U.S. users can earn staking rewards on Kraken.

How long does Kraken take to verify my location if I move countries?

Standard verification takes 24 to 48 hours. If you’re moving from a high-risk country (like Nigeria or Venezuela) to a regulated one (like Germany or Canada), it can take up to 7 days. Kraken manually reviews these cases to ensure compliance. You’ll need to submit updated ID, proof of residence, and sometimes a letter explaining your move. Delays are common if documents aren’t clear or match exactly.

Kevin Mann

November 3, 2025 AT 19:30Okay so I just spent 45 minutes trying to deposit EUR and Kraken just said 'nope' like I asked to steal a car? I live in Texas, I have a bank account, I pay taxes, and now I can't trade EUR because some bureaucrat in Brussels decided stablecoins are 'risky'? I just want to buy ETH without jumping through 17 hoops. This isn't finance, it's a prison simulation game with extra steps. 😤

Kathy Ruff

November 4, 2025 AT 19:22It's frustrating, but Kraken's strictness is actually protecting you. Most exchanges get shut down or fined for cutting corners. Look at BitMEX. Kraken paid the price so you don't have to. If you want freedom, go to an unregulated exchange - but then you're on your own if funds disappear. This isn't censorship, it's accountability. 🤝

Ryan Inouye

November 5, 2025 AT 10:36Of course they blocked New York. The state is run by lawyers who think Bitcoin is a cult. They don't want you to have financial freedom - they want you to beg the government for permission to hold your own money. And now Kraken bows to them? Pathetic. This is the end of crypto as we know it. The banks won. We lost. 😔

Cydney Proctor

November 5, 2025 AT 20:49Let’s be real - if you’re in Europe and you’re still using USDT, you’re not a sophisticated investor. You’re a speculator clinging to a 2014-era relic. EURS and EURe are far more transparent, regulated, and institutionally backed. If you can’t adapt to proper stablecoin infrastructure, you shouldn’t be trading at all. The market moves on - and so should you.

Cierra Ivery

November 7, 2025 AT 20:13Wait - so I can't trade XRP because the SEC 'might' come after Kraken? But I can trade DOGE, which has zero utility, no team, and was created as a joke? That's not logic - that's pure hypocrisy. And why are they banning Monero but letting me buy 100,000 BTC? What's the difference? Privacy vs. transparency? Please. This is just control dressed up as compliance. And they wonder why people leave?

Veeramani maran

November 8, 2025 AT 23:19bro i am from india and kraken dont allow me to deposit in inr 😭 but binance allow me to deposit inr and trade all coin... why kraken so strict? i just want to buy btc and hold... why they make life so hard? i am not russian or iranian... i am just normal guy who want to crypto... plz kraken open inr deposit... 🙏

Scot Henry

November 10, 2025 AT 05:50Honestly, I moved from California to Florida last year and had to re-verify everything. Took 5 days. Kraken asked for my new lease, a recent utility bill, and a selfie holding my ID. It was annoying, but I get it - they’re trying not to get sued. I’d rather have a slow system that works than a fast one that gets shut down tomorrow.

Sunidhi Arakere

November 11, 2025 AT 17:48Interesting. I live in India, and Kraken is not available here. But I understand why. Many countries lack clear crypto laws. It's safer for exchanges to avoid them than risk penalties. I use Binance, but I know it's not as secure. Still, I hope one day Kraken comes to India with proper licensing.

Chloe Walsh

November 12, 2025 AT 12:58So Kraken is now the bank you never asked for but have to tolerate. We used to have freedom. Now we have compliance forms. The dream was decentralized money. The reality? A government-approved financial gatekeeper with a fancy logo and a 200-page terms of service. We didn’t fight for this. We were sold a lie. And now we’re supposed to be grateful?

Jessica Arnold

November 14, 2025 AT 09:30This is the inevitable evolution of any technology that scales. The internet began as anarchic, decentralized, open - and now it’s dominated by platforms with moderation policies, age gates, and geo-restrictions. Crypto is following the same path. The question isn’t whether regulation is good or bad - it’s whether we can shape it to serve users, not just regulators.

Allison Doumith

November 16, 2025 AT 00:18I used to think Kraken was the good guy. Now I see it’s just the most polished version of the same old machine. They didn’t choose compliance - they chose survival. And now they’re selling it as virtue. But I’m not fooled. If they truly believed in decentralization, they’d let users opt into risk. Instead, they decide what’s best for us. That’s not innovation. That’s paternalism.

Grace Huegel

November 16, 2025 AT 20:58I just lost $2,300 in USDT because Kraken auto-converted it to EUR. No warning. No option. Just… gone. And now I’m stuck with euros I don’t need, while my friends on Binance are laughing all the way to the bank. I trusted them. I thought they were different. I was wrong. I feel sick.

Rob Ashton

November 17, 2025 AT 11:40Let me offer some perspective. Kraken is one of the only major exchanges with a U.S. banking license. That means your funds are protected under FDIC insurance up to $250,000 - something no other crypto platform offers. Yes, the restrictions are frustrating. But you’re trading on a platform that’s legally obligated to safeguard your assets. That’s not a bug - it’s a feature. Most people don’t even realize how lucky they are.

Vivian Efthimiopoulou

November 18, 2025 AT 11:33Let’s not forget the human cost here. In countries like Nigeria, Venezuela, and Ukraine, crypto isn’t speculation - it’s survival. People use it to send remittances, avoid hyperinflation, or pay for medicine. Kraken’s blanket bans don’t just inconvenience traders - they cut off lifelines. Compliance shouldn’t mean abandonment. There’s a middle ground between regulation and cruelty. We need to demand it.

Nitesh Bandgar

November 18, 2025 AT 21:37Broooo… Kraken is acting like a strict dad who locks the car keys because you once sped on a rainy day… but the whole neighborhood has Ferraris and nobody cares! I can’t believe they banned ZEC but let me buy Dogecoin with my grandma’s pension money… this is not justice… this is chaos with a corporate logo… I’m out. Switching to MEXC tomorrow. Peace out 🤌

Eric von Stackelberg

November 20, 2025 AT 06:49They’re not just blocking jurisdictions - they’re building a digital iron curtain. Every IP check, every document verification, every stablecoin delisting - it’s not compliance. It’s surveillance capitalism in crypto drag. They know exactly where you are, what you own, and what you’re trying to do. And they’re selling that data to regulators under the guise of ‘security.’ This isn’t finance. It’s social credit with Bitcoin.

Diana Smarandache

November 21, 2025 AT 16:20For those complaining about XRP: the SEC’s position hasn’t changed. The dismissal was procedural, not substantive. Kraken’s decision is legally prudent. If you want to trade XRP, use a non-U.S. exchange. But don’t pretend you’re fighting for freedom - you’re just ignoring risk. Discipline isn’t oppression. It’s responsibility.

Robin Hilton

November 22, 2025 AT 22:30Wow. So Kraken is now the most regulated exchange in the world. That’s great. But why does that mean I can’t use EUR? Why can’t I trade XRP? Why can’t I use a VPN? Why does every single feature I like get stripped away? I didn’t sign up for a bank. I signed up for crypto. And now I feel like I’m using a glorified PayPal with extra steps and worse UX. I’m done.