EURØP Stablecoin Comparison Tool

How EURØP Compares to Other Euro Stablecoins

EURØP is the first MiCA-compliant Euro stablecoin. See how it compares to EURS and eurt across key metrics. This tool helps EU residents understand which stablecoin meets their needs for regulated digital euros.

EURØP (EUROP) isn’t just another crypto coin. It’s a digital euro built for the real world - backed by actual euros, regulated by France’s central bank, and designed to work on blockchain networks without breaking any rules. If you’ve ever wondered how a cryptocurrency can be both legal and useful in Europe, EURØP is the answer.

What Exactly Is EURØP?

EURØP (also written as EUROP) is a stablecoin that’s 1:1 backed by euros. That means every single EUROP token in circulation has a real euro sitting in a bank account somewhere, held by licensed European financial institutions. Unlike Bitcoin or Ethereum, EURØP doesn’t swing wildly in price. It stays at €1.00 - give or take a fraction of a cent - because it’s tied directly to the value of the euro.

It’s not issued by a startup with no oversight. EURØP is created and managed by Schuman Financial, a French fintech company licensed as an Electronic Money Institution (EMI) under EU law. This isn’t some anonymous project. It’s regulated by the ACPR, the same body that watches over banks like Société Générale - where EURØP’s reserves are held.

It’s also one of the first stablecoins to fully comply with the EU’s Markets in Crypto-Assets (MiCA) regulation, which came into force in June 2024. That means EURØP had to pass strict audits, prove its reserves, and show it can be redeemed for real euros at any time. Most crypto projects can’t say that.

How Does EURØP Work?

EURØP runs on four major blockchains: Ethereum, Polygon, Avalanche, and XRP Ledger. On Ethereum and its compatible chains, it’s an ERC-20 token. On XRP Ledger, it uses the XRPL-Token standard. This cross-chain design lets users move EURØP between networks without needing a bridge or third-party service.

Here’s how it works in practice:

- If you have euros in your bank account, you can send them to Schuman Financial’s portal and get an equal amount of EUROP tokens in your wallet - instantly and for free.

- If you have EUROP tokens and want cash, you send them back to Schuman Financial and get euros wired to your bank account - again, no fees and usually within 1.5 business days.

- You can also trade EURØP on exchanges like Coinbase Pro, Bitstamp, and Kraken, or use it in DeFi apps that support it.

The system is designed for simplicity. You don’t need to be a tech expert. Any wallet that supports ERC-20 or XRPL tokens - like MetaMask, Trust Wallet, or Ledger - can hold EURØP. No special software or permissions are required.

Who Is EURØP For?

EURØP isn’t meant for everyone. It’s built for specific users who need a legal, stable, euro-denominated digital asset:

- European businesses making cross-border payments within the Eurozone. Sending EURØP between companies in Germany and Italy is faster and cheaper than using traditional SEPA transfers.

- DeFi users in the EU who want to avoid dollar-based stablecoins like USDC or USDT. EURØP lets them stay within the euro ecosystem while still accessing decentralized lending, staking, and trading.

- Institutional investors who need regulatory certainty. With MiCA compliance and monthly KPMG audits, EURØP offers a level of transparency most crypto assets don’t.

- EU residents who want to hold digital euros without relying on banks. It’s like having cash on the blockchain.

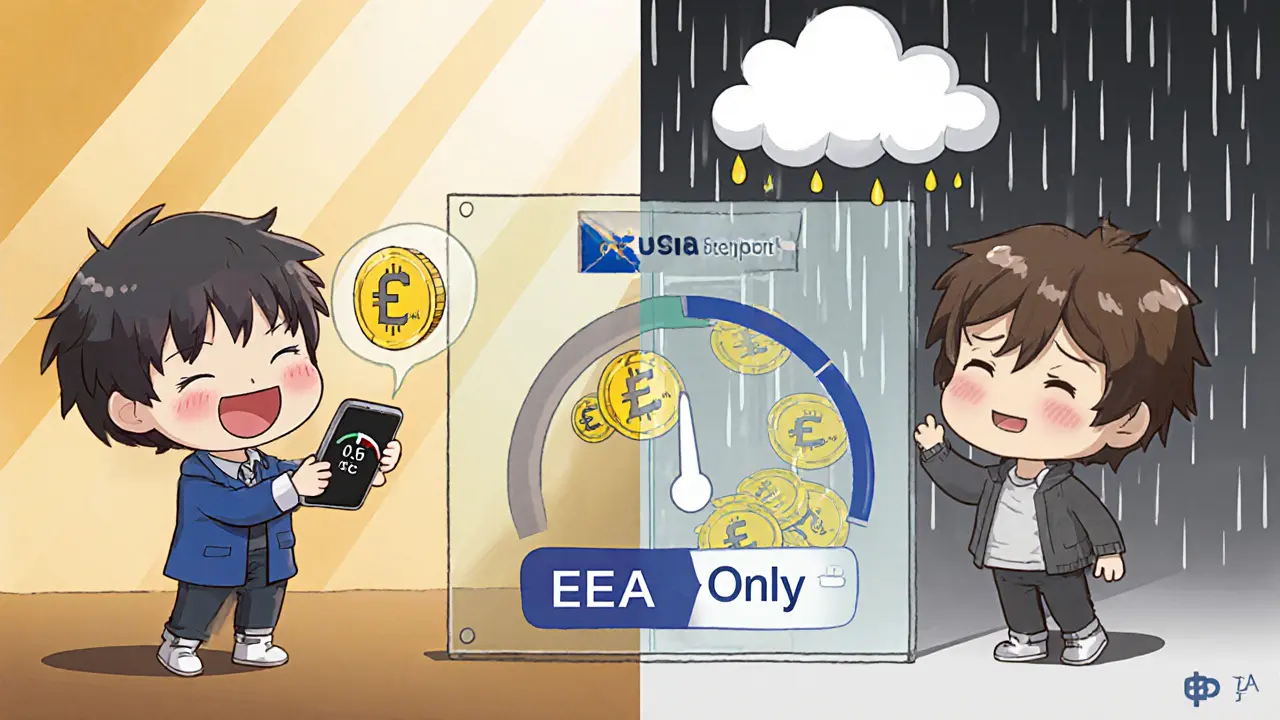

But here’s the catch: EURØP is only available to people living in the European Economic Area. If you’re outside the EU, you can’t mint or redeem it directly. And while you can trade it on some exchanges, you still need to pass KYC checks that confirm your location.

How Does EURØP Compare to Other Euro Stablecoins?

There are other euro stablecoins out there - like EURS from Stasis or eurt from Tether. But EURØP is different in one key way: it’s directly supervised by Banque de France.

Here’s how they stack up:

| Feature | EURØP (EUROP) | EURS (Stasis) | eurt (Tether) |

|---|---|---|---|

| Backing | 1:1 Euro reserves | 1:1 Euro reserves | 1:1 Euro reserves |

| Regulator | ACPR (France) | FSMA (Malta) | Not publicly disclosed |

| MiCA Compliant | Yes | Yes | No |

| Reserve Auditor | KPMG (monthly) | Deloitte (quarterly) | Not public |

| Bank Partners | Société Générale | Multiple | Unknown |

| Market Cap (July 2024) | $9.7M | $1.2B | $480M |

| DeFi TVL | $2.3M | $110M | $320M |

EURØP’s biggest weakness? Size. With a market cap under $10 million, it’s tiny compared to EURS or eurt. Its liquidity is thin - swapping large amounts can cause slippage. But its strength? Trust. When you hold EURØP, you’re holding a token backed by a regulated financial institution under one of the world’s strictest financial regimes.

Why EURØP Matters

Most crypto projects are built to avoid regulation. EURØP was built to follow it. That’s a big deal.

The European Central Bank estimates the regulated stablecoin market in Europe will hit €15.7 billion by 2025. EURØP is one of the first to clear the MiCA bar. That makes it a blueprint for what’s coming next: more stablecoins that are legal, auditable, and tied to real assets.

It also shows that blockchain isn’t just for speculation. It can be used for real financial infrastructure - faster payments, lower fees, and better transparency - without breaking the law.

Analysts at TokenInsight gave EURØP a 4.7/5 for regulatory compliance - the highest score among euro stablecoins. Even critics like Dr. Philipp Sandner from Frankfurt School Blockchain admit: “It’s the most transparent euro stablecoin we’ve seen.”

What Are the Downsides?

EURØP isn’t perfect. Here’s what you should know:

- Limited liquidity: Only 7 exchanges list it. If you want to trade large amounts, you’ll face high slippage.

- Wallet support: Only about 12 major wallets support EUROP. If your wallet doesn’t recognize ERC-20 tokens properly, you might not see your balance.

- Regional lock: You must be an EU resident to mint or redeem. No exceptions.

- Single banking partner: Right now, reserves are held mostly at Société Générale. If that bank had a major issue, redemption could slow down - though this is unlikely given its size and stability.

- Not for DeFi whales: With only $2.3 million locked in DeFi protocols, EURØP won’t move markets. It’s not a replacement for USDC in yield farming.

But if you’re an EU resident who wants to use digital euros on-chain - legally and safely - EURØP is currently the best option.

What’s Next for EURØP?

Schuman Financial’s roadmap is clear:

- Integration with the European Payments Initiative (EPI) by Q1 2025 - this could link EURØP to real-time retail payment systems across the EU.

- Expansion to three more blockchains, likely Solana and Cosmos chains.

- Increased wallet partnerships to support more retail users.

- Further reduction of transaction costs - already down 82% on Polygon zkEVM since June 2024.

Industry forecasts suggest MiCA-compliant stablecoins could process €2.1 trillion in transactions annually by 2027. EURØP is positioned to capture 12-15% of that market - not because it’s the biggest, but because it’s the most trusted.

And while the European Central Bank’s own digital euro (a central bank digital currency) is expected around 2027, EURØP won’t disappear. It’s not a competitor - it’s a bridge. It shows how private-sector innovation can work within public regulation to build real financial tools.

Can You Buy EURØP Today?

Yes - but not everywhere.

You can buy EURØP on:

- Coinbase Pro

- Bitstamp

- Kraken

- Bybit

- Gate.io

- Bitrue

- MEXC

To get it, you need to:

- Sign up on one of these exchanges.

- Complete KYC verification - you’ll need proof of EU residency.

- Deposit euros via SEPA transfer.

- Buy EURØP directly with euros.

Alternatively, you can mint EURØP directly through Schuman Financial’s portal if you’re a business or high-volume user. Retail users usually find it easier to buy on exchanges.

Don’t try to buy it on decentralized exchanges like Uniswap unless you’re trading small amounts. Liquidity is low, and you’ll pay a premium.

Final Thoughts

EURØP isn’t going to make you rich overnight. It won’t be on the front page of Bloomberg. But it’s quietly solving a real problem: how to bring the euro into the digital age without losing its legal standing.

If you’re in the EU and you care about using crypto legally, transparently, and with real backing - EURØP is the most trustworthy option you’ve got. It’s not flashy. It’s not a meme. But it’s real. And in crypto, that’s rare.

For now, it’s a niche tool for a specific group. But that niche could grow fast - especially as more businesses and institutions look for compliant ways to move money on-chain.

Is EURØP the same as the digital euro?

No. EURØP is a privately issued stablecoin backed by euros and regulated by France’s financial authority. The digital euro is a future central bank digital currency (CBDC) that would be issued directly by the European Central Bank. EURØP is a market solution; the digital euro will be a public one. They could coexist, but they’re not the same thing.

Can I use EURØP outside the EU?

You can trade EURØP on exchanges outside the EU, but you can’t mint or redeem it for euros unless you’re a resident of the European Economic Area. The service is legally restricted to EU residents only.

Is EURØP safe?

Yes - for a crypto asset. It’s backed 1:1 by euros held in regulated European banks, audited monthly by KPMG, and supervised by France’s central bank. It’s one of the most transparent stablecoins in existence. But like any crypto, you’re still responsible for securing your own wallet. If you lose your private key, you lose your EURØP.

Why is EURØP worth $1.16 USD if it’s backed by euros?

The euro is worth about $1.08-$1.16 against the US dollar depending on exchange rates. EURØP is pegged to the euro, not the dollar. So when the euro strengthens against the dollar, EURØP’s USD price rises. It’s not a bug - it’s how currency exchange works.

Can I earn interest on EURØP?

Yes - but only through DeFi platforms that support it. Some protocols offer yield on EURØP, but the liquidity is low, so returns are limited. It’s not a high-yield asset. The value is in its stability and compliance, not in speculative returns.

What happens if Schuman Financial goes bankrupt?

The euro reserves backing EURØP are held in segregated accounts at Société Générale and other banks - meaning they’re legally separate from Schuman Financial’s own assets. Even if the company fails, the reserves should still be accessible for redemption. This is a core requirement of MiCA compliance.

Kris Young

November 20, 2025 AT 12:19EURØP is backed 1:1 by euros? That’s huge. Most stablecoins claim this, but few actually prove it with monthly KPMG audits and ACPR oversight. This is the first one I’ve seen that doesn’t feel like a gamble.

LaTanya Orr

November 21, 2025 AT 11:10It’s interesting how this isn’t trying to disrupt the system but work within it. Most crypto projects want to burn down the banks. EURØP just wants to hand them a better pen.

Ashley Finlert

November 22, 2025 AT 04:05Imagine a world where digital money doesn’t require you to trust a shadowy team in the Caymans. EURØP isn’t just a token-it’s a quiet revolution in financial dignity. The euro isn’t just currency; it’s history, law, and stability encoded into code. And for the first time, that matters on-chain.

This isn’t speculative finance. This is infrastructure. And infrastructure doesn’t scream. It just works.

Compare it to USDC-where the issuer’s legal team is a mystery, and the reserve reports feel like PowerPoint slides from a startup that just hired a contractor. EURØP? KPMG publishes the ledger. France watches the vaults. That’s not marketing. That’s accountability.

It’s also the first time I’ve seen a crypto project that doesn’t feel like it’s trying to sell me a dream. It’s selling me a payment system. And that’s radical.

Why does this matter? Because the future of money won’t be built by anarchists. It’ll be built by people who understand that trust isn’t earned by decentralization-it’s earned by transparency.

If you think blockchain is about freedom from banks, you’re missing the point. Blockchain is about freedom *through* institutions that actually work.

EURØP isn’t the future of crypto. It’s the future of finance.

And yes, it’s tiny now. But so was PayPal in 2002. The real question isn’t market cap-it’s whether this model can scale. And if it can, the rest of the industry will have no choice but to follow.

Let’s not romanticize chaos. Let’s build something that lasts.

Chris Popovec

November 22, 2025 AT 20:03ACPR? KPMG? Please. This is just another central bank puppet. They’re using MiCA to lock in control. Once you’re hooked on EURØP, the government can freeze your balance, track every transaction, and tax you before you even see the balance. This isn’t crypto-it’s surveillance with a blockchain sticker.

And don’t get me started on Société Générale. That bank was fined $1.4B for laundering Russian money in 2021. You’re trusting your euros to *them*? LMAO.

Marilyn Manriquez

November 23, 2025 AT 12:25It is truly remarkable that a private entity has achieved such a high standard of regulatory compliance in the digital asset space. The discipline and foresight demonstrated by Schuman Financial are exemplary. This model should serve as a benchmark for all future financial innovations.

taliyah trice

November 25, 2025 AT 12:05So it’s just digital euros. Cool. I’ll stick with my bank app.

Charan Kumar

November 26, 2025 AT 05:20EUROP is good for europeans but why should we in india care? We dont even have digital rupee live yet

Peter Mendola

November 27, 2025 AT 03:46Market cap: $9.7M. TVL: $2.3M. Liquidity: negligible. This is a toy. Not a tool. 🤡

Terry Watson

November 28, 2025 AT 15:45Wait-so this thing is actually audited? Monthly? By KPMG? And supervised by Banque de France? I mean… I’ve seen a lot of crypto projects claim to be ‘regulated,’ but this… this feels different. Like, actually different. Like, ‘I could use this to pay my landlord’ different. I’m not even in the EU, but I’m kinda impressed. Like, weirdly impressed. Is this… is this the first crypto project that doesn’t make me feel like I’m buying a lottery ticket?

And the fact that it’s not trying to be a meme coin or a yield farm? No ‘EUROP to the moon’ nonsense? Just… clean, quiet, boring stability? That’s revolutionary.

Also-why is no one talking about how this could be the gateway for non-crypto Europeans to finally get on-chain? Like, my aunt in Lyon has no idea what DeFi is, but she uses SEPA. What if she could send EURØP to her cousin in Milan like it’s a bank transfer? That’s… actually useful.

I’m not even a crypto guy. But this? This feels like the future. Quiet. Reliable. Unsexy. And that’s the best kind.

Sunita Garasiya

November 29, 2025 AT 20:14Oh wow a euro stablecoin that’s not Tether? Who do they think they are? The IMF? 😏

Meanwhile, in the real world, people are still trying to figure out how to pay their rent with crypto. But sure, let’s all celebrate this $10M niche product that only works if you have a French ID.

Also, KPMG audits? Cute. Did they also audit the CEO’s yacht?

Mike Stadelmayer

December 1, 2025 AT 05:07I don’t use crypto for payments. But I like that someone’s building something that doesn’t feel like a casino. EURØP is like the quiet guy in the corner who shows up on time, pays his bills, and doesn’t brag. Respect.

Norm Waldon

December 1, 2025 AT 08:26France is running this? So the EU is just replacing the dollar with the euro? This is the beginning of the New World Order. They’re using MiCA to centralize control under Brussels. Soon, your wallet will be a government ID. You’ll need permission to hold EURØP. This isn’t finance-it’s digital serfdom.

neil stevenson

December 1, 2025 AT 19:56Finally someone gets it. No hype. No rug pulls. Just real money on-chain. 🙌

Samantha bambi

December 1, 2025 AT 22:18I love that this isn’t trying to be flashy. It’s not for traders. It’s for people who just want to move money without the crypto chaos. I wish more projects thought this way.

Jack Richter

December 2, 2025 AT 01:39Meh.

sky 168

December 2, 2025 AT 23:59Good to see real regulation in crypto. Hope this inspires more projects to do the same.

sammy su

December 3, 2025 AT 18:53so like… if i live in the eu and i wanna use this, i just send euros to schuman and get europ? no fees? and then i can send it to my friend in germany like a text? that’s actually kind of cool. i thought crypto was all about mining and gas fees. this feels like… normal banking but on the internet?

jack leon

December 5, 2025 AT 00:07EURØP is the phoenix rising from the ashes of every scammy stablecoin that promised the moon and delivered a dumpster fire. No hype. No memes. Just euros. On-chain. With receipts. This is what happens when you stop trying to be a crypto bro and start being a financial engineer. The future doesn’t need more billionaires-it needs more trust.

And yes, it’s small. But small things grow quietly. Bitcoin didn’t start at $60K. It started with a guy buying pizza. EURØP might not be on CoinGecko trending, but it’s the quiet heartbeat of real financial change.

Let the noise keep screaming. We’ll be over here, moving money without needing a PhD in blockchain.

Chris G

December 6, 2025 AT 14:52Market cap too low. Liquidity insufficient. Regulatory compliance irrelevant if no one uses it. This is vaporware dressed in compliance.

Phil Taylor

December 8, 2025 AT 06:54France thinks it can lead crypto? Please. The EU is a bureaucratic graveyard. This is just another EU regulation dressed up as innovation. You want real crypto? Go to Switzerland. Or the US. Not Brussels.

diljit singh

December 10, 2025 AT 01:55europ? more like euro waste. only europeans can use it and even then its just a glorified bank transfer. why would anyone care? we have uPI in india and its 100x better

Abhishek Anand

December 11, 2025 AT 07:36One must question whether regulatory compliance is a virtue or a limitation. EURØP, while technically sound, is a product of institutional capture. True decentralization requires autonomy from state-sanctioned institutions. This is not liberation-it is legitimization of the status quo. The blockchain was meant to bypass the bank, not become its digital clerk.

And yet… one cannot ignore the elegance of its design. The 1:1 backing. The transparency. The auditable reserves. It is a paradox. A beautiful, bureaucratic paradox.

Perhaps the future of money is not in rejecting institutions, but in re-architecting them-so that they serve, rather than dominate. EURØP, for all its constraints, may be the first step in that quiet revolution.

But ask yourself: are we building tools for freedom… or just better cages?

Kris Young

December 12, 2025 AT 15:47Good point about the liquidity. But if you’re not trading $10M at once, it’s fine. For SMEs sending €5K to suppliers? Perfect. It’s not meant for whales.