Crypto Exchange Risk vs. Savings Calculator

Calculate Your Real Savings

Compare FCoin's low fees against the hidden risk of lost funds

FCoin once claimed to be the cheapest crypto exchange on the market. With taker fees as low as 0.03% and maker fees at 0.029%, it sounded like a dream for active traders. But low fees don’t mean a safe or reliable exchange. In fact, FCoin’s story is a cautionary tale about what happens when a platform prioritizes price over trust.

What FCoin Actually Offered

FCoin wasn’t trying to be a beginner-friendly exchange. It didn’t accept USD, EUR, or any fiat currency. If you didn’t already own Bitcoin, Ethereum, or another major crypto, you couldn’t start trading on FCoin. You had to buy your first coins elsewhere - on Coinbase, Kraken, or Crypto.com - then move them over. That made FCoin a tool for experienced traders looking to cut costs, not a place for new investors.

The fee structure looked great on paper. At 0.03%, FCoin’s taker fee was half what Binance charged at the time, and far below Coinbase’s 0.5% to 3.99% range. Makers got a tiny edge at 0.029%, encouraging liquidity. But here’s the catch: no one could find clear information on withdrawal fees. That’s a red flag. Withdrawal fees can be hidden, high, or change without notice. On a platform that already lacked transparency, that silence wasn’t an oversight - it was a risk.

Why Users Left in Droves

One review on Cryptogeek gave FCoin a 1 out of 5. That’s not a typo. One user. One rating. And it was the lowest possible score. That doesn’t mean only one person used it. It means most people who did used it didn’t stick around - or didn’t leave feedback because they couldn’t withdraw their funds.

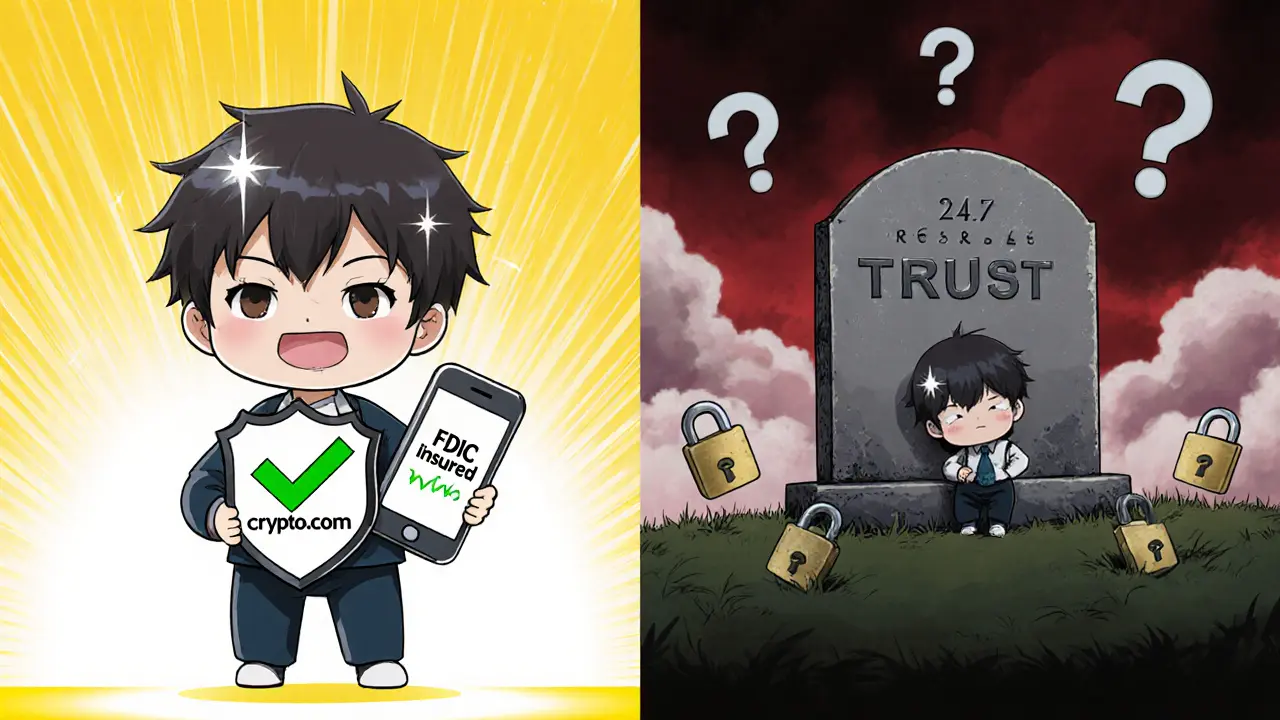

Compare that to Kraken, which has a 4.8/5 rating based on hundreds of reviews, or Crypto.com, which Finder named the best overall exchange in 2025 for its balance of low fees, security, and ease of use. FCoin had none of that. No customer support team to speak of. No security track record to reference. No public audits. No insurance on deposits. Just low fees and silence.

The Bigger Problem: No Regulatory Footprint

In 2025, the crypto exchange landscape is nothing like it was five years ago. Regulators are watching. Exchanges like Coinbase and Kraken are licensed in multiple U.S. states. They offer FDIC insurance on USD balances. They report taxes. They comply with KYC rules. FCoin did none of that. It operated in the shadows - and that’s not a feature. It’s a dealbreaker.

When exchanges don’t follow the rules, they’re not just risky - they’re unstable. They can disappear overnight. Their websites can go down. Their wallets can freeze. And when that happens, you have no legal recourse. No customer service line to call. No email reply. No lawsuit you can file. Just silence.

Why FCoin Disappeared From the Conversation

Look at any 2025 list of top crypto exchanges - Coinbase, Kraken, Binance US, Gemini, Crypto.com. FCoin isn’t there. Not even as a footnote. That’s not because it got outperformed. It’s because it’s gone. Or worse - it’s still operating, but no one trusts it enough to mention it.

The market evolved. Traders realized that a 0.01% fee difference doesn’t matter if you can’t access your money. Security matters more than speed. Compliance matters more than cost. And transparency? That’s non-negotiable.

What You Should Use Instead

If you’re looking for low fees today, you have better options:

- Robinhood - zero trading fees on crypto, simple interface, good for beginners.

- Kraken - fees from 0% to 0.40%, 11+ years without a single hack, 24/7 support, licensed in the U.S.

- Crypto.com - low fees, strong security, app-based experience, rewards program.

- Bybit - competitive taker fees at 0.055%, high liquidity, good for active traders.

None of these platforms hide their withdrawal fees. None of them require you to already own crypto to sign up. And none of them have a 1-star reputation.

Final Verdict: Avoid FCoin

FCoin’s low fees were a trap. They attracted traders looking for a bargain - but the real cost wasn’t the trading fee. It was the lack of security, the silence on withdrawals, the absence of support, and the complete lack of regulatory standing. In crypto, you don’t pay for safety with money. You pay for it with trust. And FCoin burned that trust long ago.

If you’re shopping for an exchange today, don’t fall for the cheapest option. Look for the most reliable one. Because when things go wrong - and they will, in crypto - you’ll wish you’d chosen security over savings.

Is FCoin still operating in 2025?

There’s no official confirmation that FCoin shut down, but it’s no longer listed in any reputable 2025 exchange rankings, and its website is either offline or severely outdated. Most users and analysts consider it inactive or abandoned. Even if it’s technically running, no credible trader recommends it due to its history of opacity and poor user experience.

Why didn’t FCoin accept fiat deposits?

FCoin likely avoided fiat to sidestep regulatory scrutiny. Accepting USD, EUR, or other government-backed currencies requires licenses, bank partnerships, and compliance with anti-money laundering rules. By limiting itself to crypto-to-crypto trades, FCoin operated in a legal gray area - which made it cheaper to run but far riskier for users.

Can I still withdraw my funds from FCoin?

There are no verified reports of users successfully withdrawing from FCoin in the past two years. The exchange never published clear withdrawal fee schedules, and user complaints about frozen accounts were common before its decline. If you still hold funds there, assume they’re inaccessible. The lack of transparency and support makes recovery unlikely.

What’s the safest crypto exchange for beginners in 2025?

Crypto.com is widely considered the best overall for beginners due to its simple app, low fees, strong security, and support for fiat deposits. Coinbase is also a top choice, especially for U.S. users, because it’s regulated, insured, and offers educational resources. Both let you buy crypto with a bank transfer or debit card - no need to find another exchange first.

Are low trading fees the most important factor when choosing a crypto exchange?

No. While low fees help, they’re secondary to security, reliability, and accessibility. An exchange with 0.1% fees but no withdrawal options or customer support is worse than one with 0.4% fees that lets you easily deposit, trade, and withdraw - and actually answers your questions. Most experienced traders prioritize platforms with proven track records, not just the lowest numbers on a fee chart.

gerald buddiman

November 6, 2025 AT 16:49This post hit me right in the feels... I lost my entire BTC stack on FCoin back in '23. I thought I was getting a deal, but no one warned me about the withdrawal freeze. I cried for three days. I still check their site every Sunday like a fool. It’s gone now. Just... gone. I’m scared to trade again. What if it happens again? I don’t even trust Binance anymore. 😭

Arjun Ullas

November 7, 2025 AT 06:46It is imperative to underscore that the operational model of FCoin contravenes the fundamental tenets of fiduciary responsibility in digital asset markets. The absence of regulatory compliance, coupled with opaque fee structures and non-existent customer support mechanisms, renders such platforms not merely suboptimal, but categorically hazardous. Investors must prioritize institutional-grade infrastructure over marginal fee differentials.

Sierra Rustami

November 8, 2025 AT 09:47USA built the internet. FCoin? Some sketchy offshore shell company. You think low fees matter when your coins vanish? Wake up. Trust isn't optional. It's the whole damn point.

Glen Meyer

November 9, 2025 AT 10:36Oh please. You think Kraken’s safe? They’re just the FBI’s favorite crypto babysitter. FCoin was real. Free. Unshackled. They didn’t need your ID or your tax forms. You think that’s bad? That’s freedom. You’re just mad because you got caught with your pants down.

Christopher Evans

November 10, 2025 AT 03:56The structural risks associated with unregulated exchanges are well-documented. FCoin’s collapse was neither sudden nor unexpected. Its operational model lacked accountability, transparency, and legal grounding. The subsequent user losses were predictable and avoidable. This is not a cautionary tale-it is a textbook case study in market failure.

Ryan McCarthy

November 11, 2025 AT 18:35I get it. Low fees are sexy. But imagine if your house had the cheapest paint job ever… but no locks, no windows, and the foundation was made of sand. You’d still move in? I used to chase the lowest fee too. Then I lost $2k. Now I pay a little more to sleep at night. Worth every penny.

Abelard Rocker

November 12, 2025 AT 14:50Let me tell you something about FCoin, my friends. It wasn’t just an exchange-it was a symphony of chaos conducted by a madman with a keyboard and a dream. The taker fees? A siren song. The withdrawal silence? The final chord. People called it a scam. I called it performance art. A tragic, beautiful, crypto opera where the audience was the victim, the stage was the blockchain, and the curtain? Never came down. It just… evaporated. Like smoke. Like hope. Like my ETH balance on a Tuesday afternoon. I still dream about it. Sometimes I wake up screaming. Other times, I just laugh. And cry. And laugh again. Is it dead? Maybe. But its ghost? Oh, it’s still trading. In our heads. In our fears. In every new trader who thinks ‘low fee’ means ‘safe.’

Hope Aubrey

November 13, 2025 AT 11:09LOL at people acting like FCoin was some kind of villain. It was the OG crypto rebel. You think Kraken’s legit? They report to the IRS. They’re basically a bank with a crypto veneer. FCoin? Real crypto. No KYC. No babysitting. You want freedom? Then you take the risk. I lost everything. And I’d do it again. Because real traders don’t need a license to trade. They need balls.

andrew seeby

November 13, 2025 AT 19:07bro i tried fcoin once... i sent my btc... waited 3 weeks... nothing... then the site just went dark... i still check it every month like it's gonna magically work again 🤡 maybe next time i'll just use robinhood... or at least sleep at night 😅

Matthew Gonzalez

November 14, 2025 AT 12:58There’s a deeper truth here: we don’t trade crypto for the fees. We trade it because we believe in decentralization. But FCoin didn’t decentralize anything. It just outsourced the risk to the user. It wasn’t liberation-it was abandonment. The real question isn’t ‘why did FCoin fail?’ It’s ‘why do we keep letting ourselves be seduced by the illusion of freedom without responsibility?’

John Doe

November 14, 2025 AT 23:10FCoin was a CIA operation. They let people deposit so they could track every crypto wallet in the world. Then they vanished. Now the NSA has your entire portfolio. That’s why they never had withdrawal fees-they didn’t need to. They already had your coins. And your data. And your soul. 🕵️♂️👁️

Ryan Inouye

November 15, 2025 AT 10:34Oh wow, another ‘trust over fees’ lecture. How cute. You’re probably the same guy who cried when his Coinbase account got frozen for ‘suspicious activity.’ You think you’re safe? You’re just a sheep in a bigger pen. FCoin was the only exchange that didn’t treat you like a child. You didn’t lose money-you lost your illusion of control. Grow up.

Rob Ashton

November 16, 2025 AT 08:03Thank you for this comprehensive and thoughtful analysis. It is vital that new participants in the digital asset ecosystem understand that sustainability and integrity must precede cost efficiency. The choices we make as traders shape the future of our financial autonomy. I encourage everyone to reflect on the principles of responsible participation.

Cydney Proctor

November 16, 2025 AT 11:52How quaint. You wrote a 2,000-word essay on why FCoin was bad. Meanwhile, I’m on Bybit making 0.055% trades with 24/7 support and a real legal entity behind it. You’re still mourning a ghost. I’m making money. The difference? I don’t romanticize failure. I choose winners.

Veeramani maran

November 17, 2025 AT 14:33bro FCoin was lit!! i lost 0.5 BTC but i learned so much!! now i use binance but i still miss the wild west days!! 😭🔥